Maybe buying a Ferrari isn’t quite in the budget right now. No worries, you’re not alone. A new 458 Spider lists for $263,500, after all. But, perhaps an enticing alternative to peeling out of the dealer’s lot in that shiny new 458 is to own some shares of the famous Italian luxury sports car maker. That’s not a bad conversation starter, either.

Indeed, there will be a certain level of novelty attached to this IPO. The mere idea of owing a piece of such a legendary brand in the auto industry should lure some investors in. But, the question is, if we look under the hood of this deal, do the actual fundamentals of the company match the glamour of the brand name and the buzz surrounding the IPO? Or is its’ 17.2 million share IPO destined to crash and burn?

Review of “The Prancing Horse” and its’ $858 million IPO

Before kicking the tires on the company itself, there are a couple things to know about the IPO itself. First, the deal will consist of 17.2 million shares, expected to price within a range of $48-$52, for expected gross proceeds of $858.5 million. The lead underwriters on the IPO are UBS, BofA Merrill Lynch, Allen & Co, JP Morgan, Banco Santander, and BNP Paribas.

It’s important to note that Ferrari itself isn’t selling any shares, so, none of the proceeds will be funneled to the company. Instead, all of the shares are being offered by Fiat Chrysler Automobiles, or, FCA, which is planning to fully separate itself from Ferrari. Currently, FCA owns 90% of Ferrari. After the deal, that stake will be reduced to 80% and then FCA will eventually transfer that stake to its’ shareholders via a series of transactions. The remaining 10% of the company (prior to IPO) is owned by Piero Lardi Ferrari, the son of founder Enzo Ferrari, who launched the auto maker in 1929.

When most people think about Ferrari, the first thought that probably comes to mind is a sleek, red luxurious sports car driving down the street or highway. But, Ferrari’s roots are really in Formula 1 racing (hence the ticker “RACE”) and its’ racing team called “Scuderia Ferrari. The team has won an astounding 222 Grand Prix races, making it the most successful in Formula 1 history.

Of course, RACE generates most of its’ revenue from selling cars and parts (~70% of revenue) and the company has a loyal customer base, illustrated by the fact that more than a third of its’ customers own more than one Ferrari. Obviously, RACE targets high net worth individuals, which is a positive aspect to the business because the size and capacity of this client base has grown significantly in recent years — particularly in emerging markets. Additionally, this client base tends to be more insulated in times of economic down turns and market turmoil.

Ferrari also produces V6 and V8 engines for Maserati, accounting for about 11% of revenue. RACE has a multi-year agreement with Maserati to provide V6 engines in an initial production run of up to 160,000 engines through 2020, which is expected to increase to up to 275,000 engines through 2023. It’s important to note, though, that in its’ IPO prospectus, RACE said it expects revenue generated from the sales of engines to Maserati to decrease into 3Q15 as a result of lower volumes ordered with its’ contract manufacturing agreement.

Lastly, RACE generates revenue from licensing its’ brand name and logo to companies like Lego and Oakley Sunglasses, and through sponsorship deals. This accounts for about 15% of total revenue.

Fast & Expensive Cars, Slow Growth & Expensive Shares

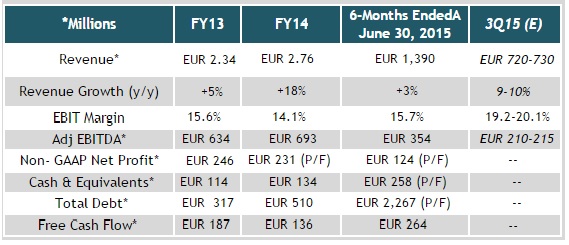

The good news is, RACE is comfortably profitable, has a track record of profitability, its’ EBIT margins are pretty healthy for a car company, and it generates a good amount of cash. However, the company is not growing very quickly, thanks to its’ self-imposed limits on production of about 7,000 units annually. Given the importance it places on price and exclusivity, the company isn’t likely to dramatically bump up production any time soon, either.

The balance sheet is also bogged down with debt with EUR 2.27 billion on the books, and as we note below, the valuation of the company seems quite high relative to its revenue and earnings.

First, looking at its’ results for the 6-months ended June 30, 2015, revenue ticked up 3% to EUR 1.39 billion. Revenue from cars and car parts increased by 6%, but, dragging down the overall topline growth was a 20% dip in revenue from engines. This was driven by lower sales to Maserati due to a lower volume of engines shipped.

Cost of sales declined, though, by 2%, again, as a result of lower sales to Maserati, as well as technical and commercial savings of EUR 3 million and a decrease in the costs of sales of supporting activities of EUR 4 million.

SG&A costs also fell year/year by 2% to EUR 722 million and accounted for 52.1% of revenue versus 54.7% in the year ago period. The drop in cost of sales and SG&A costs enabled RACE’s EBIT to grow by 18% year/year to EUR 218 million. GAAP Net Profit rose by 10% to EUR 141 million. RACE also generated EUR 264 million in free cash flow for the period.

Taking a look at valuation, RACE is poised to have a market cap of around $9.5 billion, assuming the IPO prices at the mid-point of the expected range. That means that it would be trading with a P/E of about 33x annualized FY net profit, based on today’s currency exchange rates.

Conclusion

Owning Ferrari — the stock that is — has a nice ring to it, no question. The name brand is synonymous with luxury, high class, and unparalleled performance. So, it’s not every day that a company with such appeal and prestige decides to go public, making its’ IPO exclusive, just like its’ cars.

From a fundamental perspective, thought, it is really a mixed bag for RACE. On the positive side, the company is profitable and generates good cash flow. And its’ upper class target market really insulates the company against economic downturns, making RACE a pretty stable and predictable company.

There are some clear negatives too. We’ve pointed out the strategy to restrain production essentially puts a cap on its revenue growth. The company now faces a dilemma in that, investors will surely be looking for better growth from the company, and will sell stock if it doesn’t … but on the other hand, ramping production will dilute the brand, the exclusivity of owning a Ferrari will be lessened, and the value of the brand could take a hit. RACE will strive for a balance here, using the term “controlled growth” in its’ prospectus. Whether that is enough to satisfy investors is a major question mark.

And then there’s the valuation. At $50/share, RACE would be valued at just under $9.5 billion, which is 33x annualized FY15 earnings. That type of multiple is typically seen on a higher growth company, not one that is growing revenue by single digits and net profit by 10%. The argument is that RACE deserves a premium valuation because it is a premium brand and company. That makes sense, and we would agree with that. But, 33x just seems quite high to us, and leaves little room for upside, in our view.

Overall, this is a “sexy” IPO that is certain to generate some buzz next week. But, from a growth perspective, it’s difficult to be too excited about the deal. It seems possible that investors and management’s goals may not be fully aligned here, given RACE’s reluctance to increase production, which puts a lid on revenue growth. This then begs the question: Would Ferrari just be better off staying private?