I love shopping for groceries when things are on sale and I tend to buy more when I can get more for less. Yet, it doesn’t seem to work this way when one of the world’s largest retailer and employer with over 2.2 million staff is on sale.

A recent 33% price drop, and we all run to the exits and tighten our wallets.

This is why it is so important to buy stock undervalued, because eventually over the long term, things always come back to fundamental intrinsic value.

Walmart is no exception. Well over valued back in 1999 (priced for growth at over forty times earnings) but finally back in value at a more affordable twelve to thirteen times earnings.

What do I think of Walmart at current prices? The following speaks for itself. And I’m not even talking about price charts. Note that I haven’t even included a price chart this time, just pure facts and figures of an incredible business.

Note that if you could afford to buy the entire Walmart (not that you can since the Walton Family still own over 50% of the company, essentially making it a family run mega business), at today’s market capitalization of about $188 Billion, is in fact less than the $230 Billion market capitalization it commanded all the way back in 1999!

So essentially, Walmart has gone nowhere in the past 15 years for the poor shareholders who purchased at nose bleed valuations.

Yet, its business performance is very different and speaks for itself.

How different? Let’s summarize.

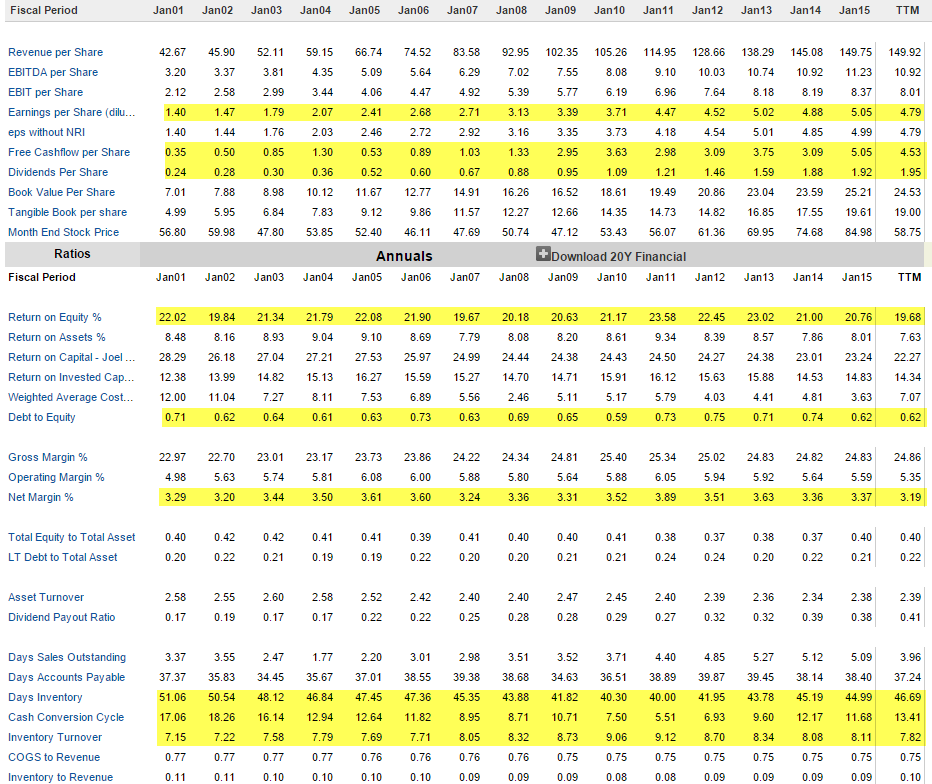

Earnings Per Share has increased from $1.40 to $4.79 (3.4 times)

Free Cash flow Per Share has increased from $0.35 to $4.53 (12.9 times)

Dividends Per Share has increased from $0.24 to $1.95 (8.1 times)

Return on Equity has been stable through the years at about 20%

Debt levels has actually decreased from 71% to 62%

Net profit margins has remained stable through the years at about 3.2%

And all other important retailer metrics like inventory turnover, cash conversion cycle etc. have all improved.

Walmart is essentially an incredible business which will be around for decades to come, and hence Warren Buffett himself is Walmart’s largest shareholder outside the Walton family holdings with over 60 Million shares and currently valued at about $3.5 Billion.

Conclusion

Walmart is currently undervalued and temporarily out of favour which is what I love. A fundamentally strong company with monopolistic characteristics and smart money support.

Do I think Walmart’s stock price will recover quickly to its former glory? No idea. But what I do know is that I am getting an incredible low risk business at the right price, which is rare.

I will be personally adding Walmart into our long term portfolio over the coming days once buying volume demand returns.