On October 20th, Chipotle Mexican Grill reported Q3 earnings of $4.59 vs the $4.62 Wall Street consensus estimate on in-line revenues of $1.22B. While you never want to see an EPS miss, especially for a higher growth/multiple stock like CMG, there were several data points from the latest quarter that may warrant investors to consider buying the post-earnings sell off.

First, revenue growth was 12.2% on a year over year basis as comps increased 2.6% (topping projections for +2.5%). Operating margins remain at a stellar level for most billion dollar corporations, let alone a restaurant company. Increased labor and promotion costs have negatively impacted results. However, a spike in customer visits per location and new store openings (215-225 in FY15 vs previous guidance of 190-205) is offsetting those expenses. This will actually accelerate to 220-235 new store openings in FY16. Comp growth projections are still calling for +5.0-5.5% this year and in 2016.

Looking at valuation, CMG trades at a P/E ratio of 32.24x (FY16 estimates), price to sales ratio of 4.95x, and a price to book ratio of 9.76x. Factoring in the bottom line strength, the forward PEG ratio is currently at 1.71x, meaning there is still more room to go before hitting the expensive benchmark (2.00x or above).

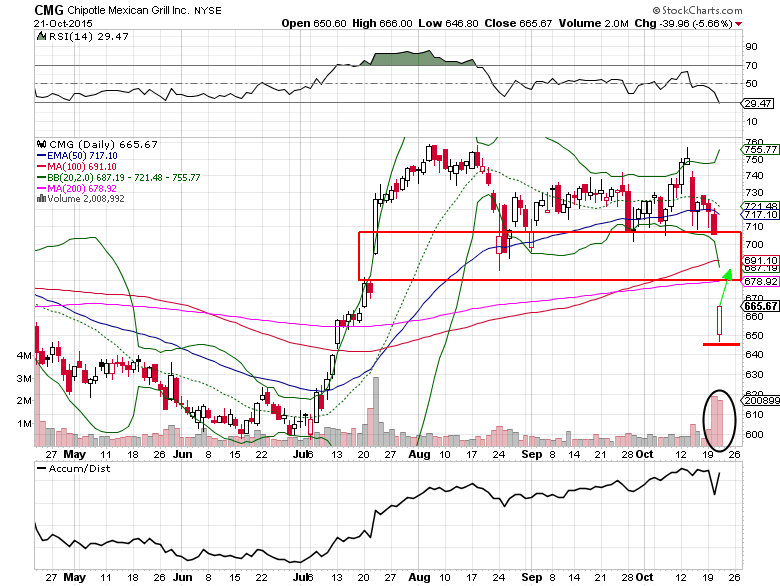

As is typically when a stock misses quarterly expectations and/or drops 5%+ on the results, many analysts downgrade or lower their price targets. Normally this would add fuel to the fire, but the 6-month daily chart below paints a different picture.

Shares did of course fall more than 5% on October 21st (earnings released the night before), but closed $15 higher than the opening print on 4x the average daily volume. Down about 12% from the all-time high, now is the time to take a low risk intermediate-term trade, following the bullish post-earnings reversal. A stop loss can be placed under $646 (intra-day low was $646.80) on a long stock positon. Look for upside potential to $680, or the 200-day simple moving average, in the next couple of weeks; $690-$705 potentially by the end of the year.

Chipotle Options Trade Idea

Buy the Dec $665/$700 bull call spread for a $14.00 debit or better

(Buy the Dec $665 call and sell the Dec $700 call, all in one trade)

Stop loss- $6.50

1st upside target- $25.00

2nd upside target- $34.00

Click here to learn more about Mitchell’s OptionsRiskManagement.com and the services he offers.