Yesterday the European Central Bank didn’t do anything. But it said it might, and that was enough to send US equity markets and the US dollar soaring … and enough to create more problems the US Federal Reserve doesn’t want to face. Especially not now.

Yesterday the ECB Chairman, Mario Draghi held a scheduled and well-publicized press conference about future ECB policy. He didn’t actually announce any new policies. But he did mention two items that sent US stocks running up and the Euro running down

He said the ECB had been discussing further cuts to interest rates, even though the ECB deposit rate is already negative. And he said the ECB is thinking about expanding its Quantitative Easing program in December.

(Actually what he said was: “the degree of monetary policy accommodation will need to be re-examined at our December monetary policy meeting.” See how little it takes to move the market?).

Negative interest rates blow bubbles. In Denmark, for example, where interest rates have been negative for more than three years and there are documented cases of borrowers being paid to take out loans (so banks can avoid paying interest on their deposits) the value of real estate in Copenhagen has increased 40% to 60% in three years. Denmark’s last real estate bubble burst just seven years ago, and the new one has barely begun.

So nobody wants more bubble. But nobody really wants interest rates to increase either, or the inevitable consequence, a stronger currency.

The first effect of Draghi’s remarks was the biggest decline in the Euro against the US dollar in nine months. And that’s also why Draghi’s statements yesterday present some problems for Janet Yellen, the Chair of the US Federal Reserve.

The Fed has promised it will raise interest rates this year, but has made one excuse after another to avoid doing it. If it hopes to retain even a shred of credibility on the Street some kind of token increase is required at the December meeting. We are already hearing some tough talk from Fed “hawks” to that effect.

But even a token rate increase would increase the value of the US dollar in foreign currency markets. The US dollar has been rising steadily for most of the year, which is a growing concern, both to the emerging markets who see their local currencies dumped as the hot money rushes into the US, and to the US companies that hope to sell stuff abroad.

The international currency markets are starting to look like a global game of pass the potato, as governments everywhere look for ways to improve their foreign trade potential by devaluing their currency. Everybody can’t win this game; eventually no one does.

Draghi’s statement did help Yellen with a secondary problem. The Street believes the Fed avoids raising rates because it is afraid to crash the market. The ECB’s “action” removes a lot of that worry.

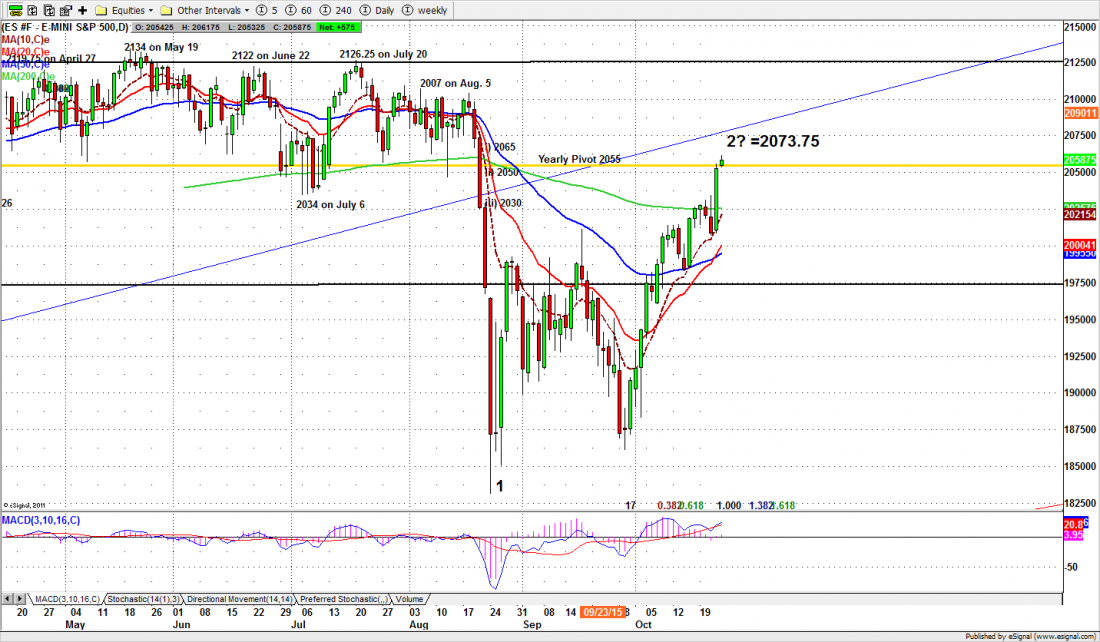

US equity markets went pretty much straight up after the ECB statement. After stalling at the 2030 level the whole week the S&P500 mini futures (ESZ5) which we trade, closed at 2053, up about 45 points from the previous close. It even rallied a bit further in overnight trading.

The minis not only broke above the 200-day moving average line, they closed near our yearly pivot level in the 2055 area. The 20-day moving average also crossed above the 50-day moving average yesterday and gave another buying signal. Happy days are here again!

Today is option expiration, and there will be some infighting between the buyers and sellers, but the upside momentum is strong. We are convinced that 1831, the August crash low, is the low for the year; and that 1950 could be the low for the next two months and beyond.

And today, any drop into the 2021.75 level will bring the buyers rushing in. Barring some major news, buy the dips today.

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/

Chart: ESZ5 daily chart, Oct. 22, 2015-10-23