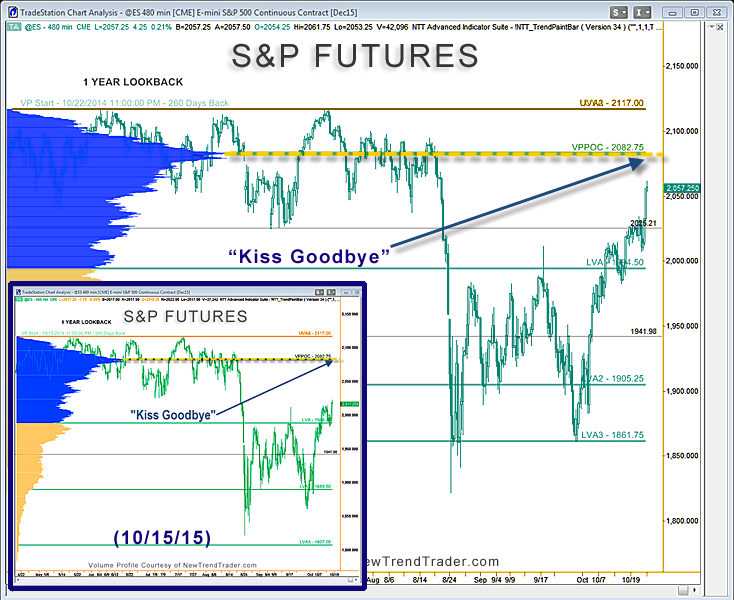

A week ago I wrote an article predicting a rally in the S&P futures up to 2082 (see inset). As I mentioned at the time, this is a magnetic number. 2082 is the Volume Profile Point of Control for a look-back of one year in the S&P futures. That is the price at which the highest volume over the last year occurred.

Although the market did a fair amount of backing and filling earlier in the week, I believe Thursday’s rally marked the resumption of the move toward this target. Like most market technicians, I also believe news will be interpreted so as to justify moves to pre-existing technical levels. So, thank you Dr. Draghi for providing the catalyst.

Despite the heady exuberance, it’s possible that this will be the last rally of the 6-year bull market. In other words, a Long Kiss Goodbye. Not only will the VPPOC act as a barrier for any further price advance, but perhaps you have noticed that several former leadership stocks are not participating in this rally (Apple and Netflix.) Additionally, biotech is completely out of oxygen and can’t get out of bed.

These three former heroes will most likely lead the market lower once business at 2082 is complete.

www.daytradingpsychology.com (for individual traders)

www.trader-analytics.com (for hedge funds and banks)