Equity markets continue to defy our call for no end-of-year rally. SPX has broken the mid-Sept high at 2,020 leaving behind a series of higher highs and higher lows; the definition of an uptrend. Price is the ultimate arbiter but we cannot ignore other signals if we want to be successful in forecasting price.

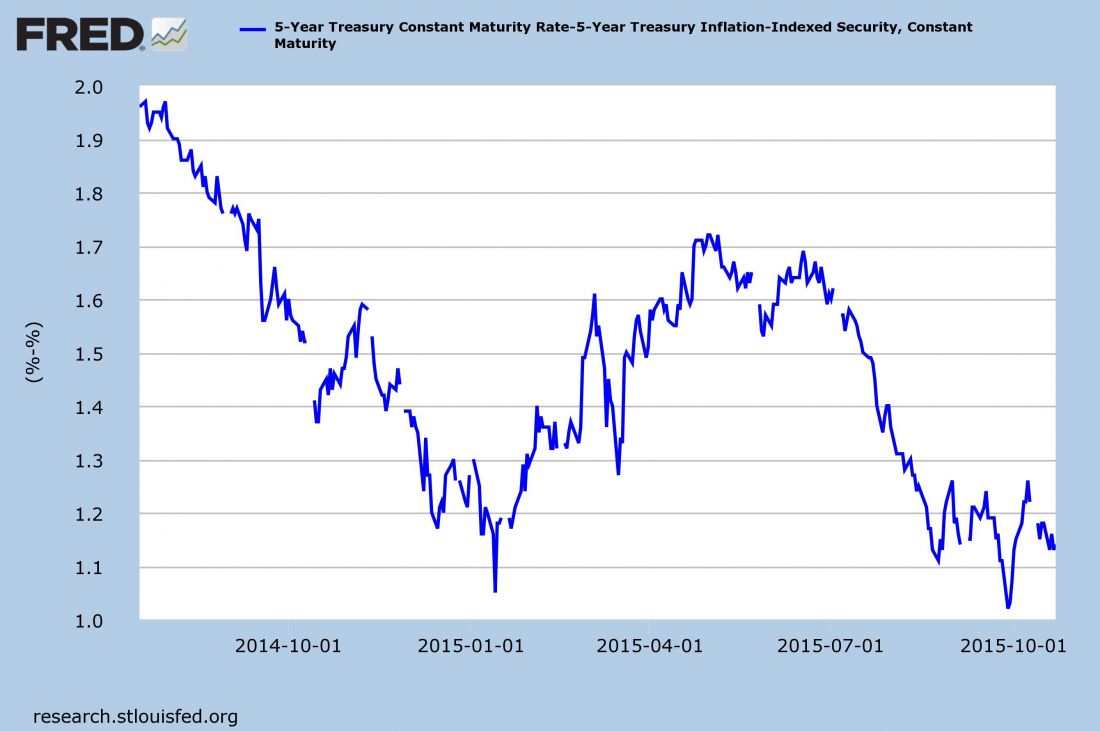

Inflation expectations (chart) bounced after testing the January low but are falling again and may get a chance to re-test the lows during the next pullback in equities. A break to new lows would be very bearish for equities.

A close by the yield on the 10 year treasury (TNX)below the February low at 16.75 would be deflationary and bearish equities.

The US Dollarmay have printed the expected double bottom during the previous week giving us the cycle low we’ve been waiting on. A rising Dollar is deflationary which is bearish-equities.

Small Caps have been underperforming during the fall rally and have not exceeded their Sept high. Relative performance (vs. SPX) is breaking down from what may be described as a bearish head-and-shoulders pattern. A bull market without leadership from small caps should be considered suspect.

Try a trial subscription at Seattle Technical Advisors.