Last Monday I wrote a bearish follow up article on the biotech sector, which has been notably lackluster even as the rest of the market has rallied. I’ve been expecting a rally in the S&P futures to 2082, and on Friday the ES came within 8 points of that target.

What had me concerned is that several market leaders, particularly Biotech, Apple and Netflix, were not participating. On Friday, however, Apple did breakout (up 3.18%), which fueled the 2.7% surge in the QQQ. Netflix remains range bound as does Biotech.

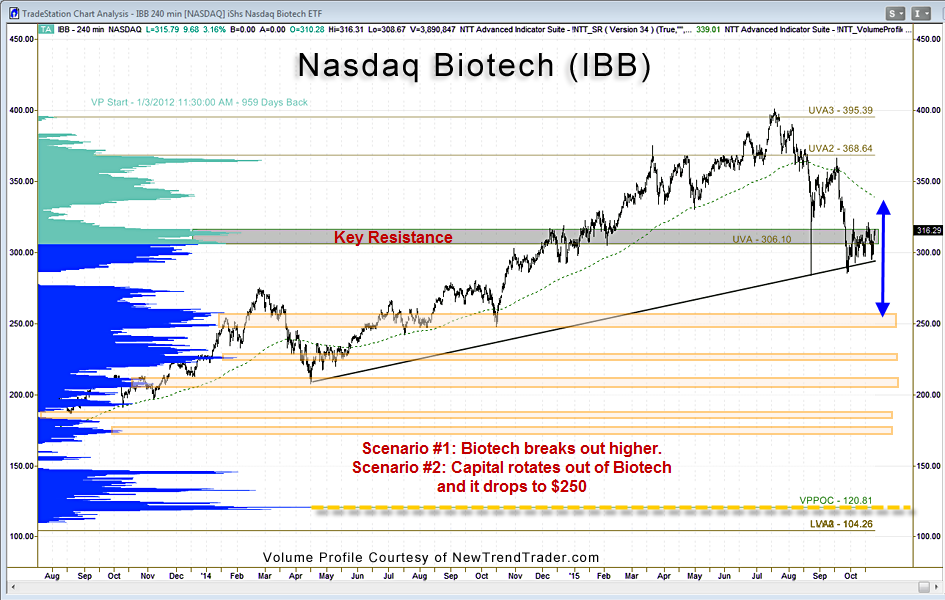

The Nasdaq Biotech ETF (IBB) is my reference ETF for the sector, as it is the volume leader in the biotech ETF space. IBB consists of 143 stocks, with a trailing P/E ratio of 26. The top 10 holdings account for 60% of the market cap.

The Volume Profile chart with this article shows IBB at trendline support… and at resistance from a high volume node. Checking a few monthly charts, overall, the Nasdaq is looking strong, even without the participation of biotech. In other words, Biotech may not matter much anymore. Two scenarios come to mind.

Scenario #1) IBB consolidates for a while longer and then breaks out higher.

Scenario #2) Capital seamlessly rotates from Biotech to other leadership names and IBB drops to $250.

I favor scenario #2. Either way, it’s looking like we will get a year-end “Santa Claus” rally in the market led by the Nasdaq and Nasdaq 100 starting in November. Due to Volume Profile considerations, I don’t expect the S&P 500 to participate.

If you would like to receive a primer on using Volume Profile, please click here: www.daytradingpsychology.com/contact