Should Be A Busy Day

The last two days the S&P500 futures (ES) have been boooorrring. This is a consolidation time, when the market digests the previous gains and tries to decide what to do next.

There are two major events that will probably change that today: yesterday’s release of Apple Inc.’s third quarter results, and the Federal Reserve’s policy meeting which concludes this afternoon (Wednesday). Both have enough horsepower to generate big action in the US equity indices.

First APPL

AAPL’s Q3 results yesterday were good but not surprising. The quarter that ends Sept. 26 is traditionally weak in comparison to the quarter that ends in December – every kid wants an IPhone for Christmas—but the numbers were staggering, or would be for any other company.

Revenue was $51.5 billion, up 22% from the same quarter a year ago, and slightly above analysts’ expectations of $51.1 billion. EPS were $1.96 – APPL has a very aggressive share buy-back program – versus expectations of $1.88. The gross margin was just a hair under 40%; anybody else would kill for those margins.

And the quarter only included two days when the latest IPhones were being sold. The new models are still being rolled out around the world; they go on sale in Australia today. When they are available everywhere, expect sales to jump again.

So what’s not to like? Financially, nothing. Every company in the world would love numbers like those.

But APPL has largely become a one-trick pony; IPhone sales account for more revenue than every other Apple product and service combined, and a disproportionate share of IPhones are sold in Greater China (which includes Hong Kong and Taiwan).

The latest model IPhone is a status symbol for Chinese teenagers, and that brought Apple more than $12 billion in revenue in the quarter. But teenagers are fickle. If/when the IPhone loses it cachet, there better be something else from Apple to replace it.

That may be why the market reaction to Apple’s results was muted in overnight trading. The stock did nothing after pretty good results. But we could see some action when the big boys start working this morning.

The Fed

The other event that will move the market around today is the Federal Reserve’s policy statement, to be released after lunch.

This is likely to be more of the same stuff we’ve seen month in and month out for most of the year. There will be rumors and leaks leading up to the statement, and endless bloviating about minor changes in language. But don’t expect any real change.

That doesn’t mean it won’t whip the market around. The Fed has been remarkably successful in keeping the market elevated on little more than hot air. Our guess is that they will try to do it again, perhaps with a sharp decline followed by an equally sharp rally. They’ve done it before… so why change what’s working?

Today

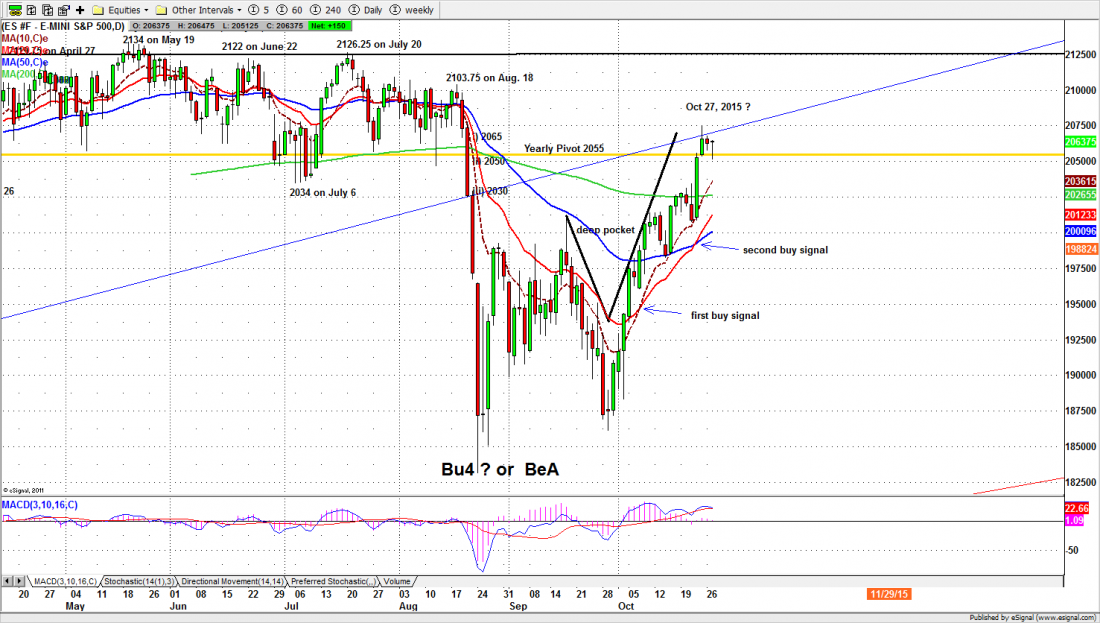

ES shouldn’t go above 2093.50 today, and should not fall below 2025.

2074.50-78.50 is the first resistance zone and 2088.75-93.50 is the second resistance zone. 2038.50-35.50 is the first support zone and 2025-23.50 the second support zone.

As long as ES doesn’t go below 2023.50, our trades today will be “buy the dip” on weakness and “sell the pops” when the price moves up. But anything can happen on FOMC days. So trade with caution.

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/