On October 28th, it came as no surprise that the U.S. Federal Reserve didn’t begin their long awaited move off of the zero interest rate policy (ZIRP). The commentary from the Fed was more hawkish, which consequently led to sharp jump in the financials and a pullback in the price of gold. Prior to the October meeting the December Fed Funds Futures were pricing in only a 37% chance of a hike, but now that number stands at 46% just a day later. Of course this number is well off of the highs from June (80%+ probability) and it basically means it is a coin flip at this point. However, it will be interesting to see if momentum can last and Janet and the other Fed officials act in 2015, something many market participants are betting on until 2016 or beyond.

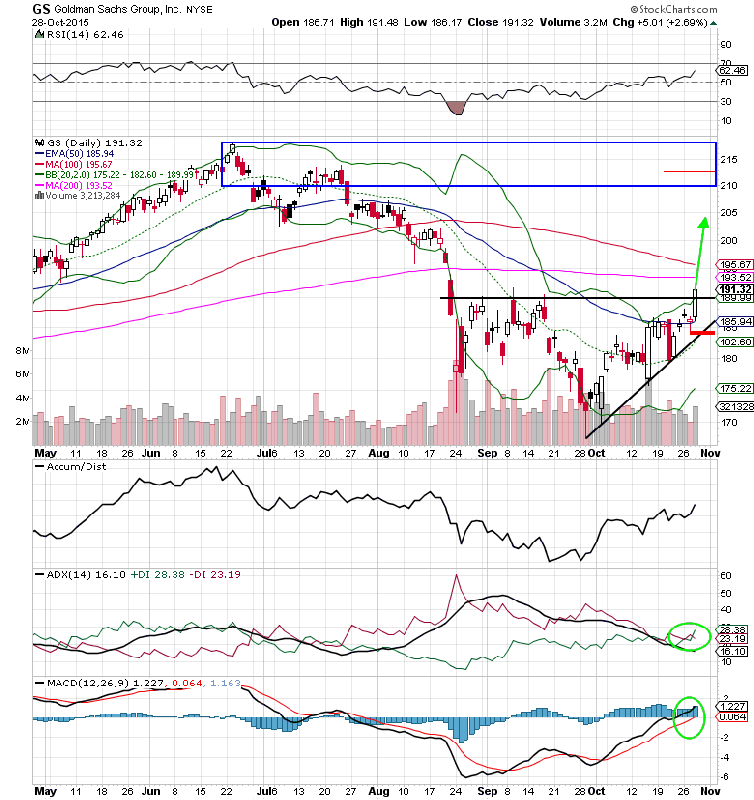

Now taking a look at the 6-month chart of Goldman Sachs we can shares positively reacted to the FOMC headlines, rising nearly 3% on the day. What’s even more impressive is that it led to a breakout above the $190 resistance level (preceded by higher lows over the past month). On a measured move basis the rally could extend towards $212.50 (using the September low of $167.49 as a reference point) in the coming months. Major resistance is still in the $210-$218 range. To keep a favorable reward/risk ratio, a stop loss on a long stock position can be placed under the recent uptrend line around $184.50.

Fundamentals

Q3 earnings results weren’t much to brag about for the $80B investment banker, but there are bright spots in the fundamental/valuation side of Goldman Sachs. Investment banking net revenues were up 6% in the third quarter to $1.56 and with the pick up in M&A financial advisory revenue spiked to $809M, a 36% increase. Overall tepid results led to some belt tightening at the company as operating expenses fell 5% to $4.82B.

GS trades at a P/E ratio of 10.10x (2016 estimates), price to sales ratio of 2.43x, and a price to book ratio of 1.10x. They are projected to hit multi-years in revenue (top the $35B mark) next year and see 20%+ upside in full year EPS to around $19 per share.

Goldman Sachs Options Trade Idea

Buy the Jan 15 2016 $195/$210 bull call spread for a $4.00 debit or better

(Buy the Jan 15 2016 $195 call and sell the Jan 15 2016 $210 call, all in one trade)

1st upside target- $8.00

2nd upside target- $14.00

Click here to learn more about Mitchell’s OptionsRiskManagement.com and the services he offers.