Hope you were long in October, because this is an all-time record

So there goes October. By the time it exits the stage at the market close this afternoon it will have established a new record: the biggest one-month gain for the S&P500 large-cap index in the history of the US stock market.

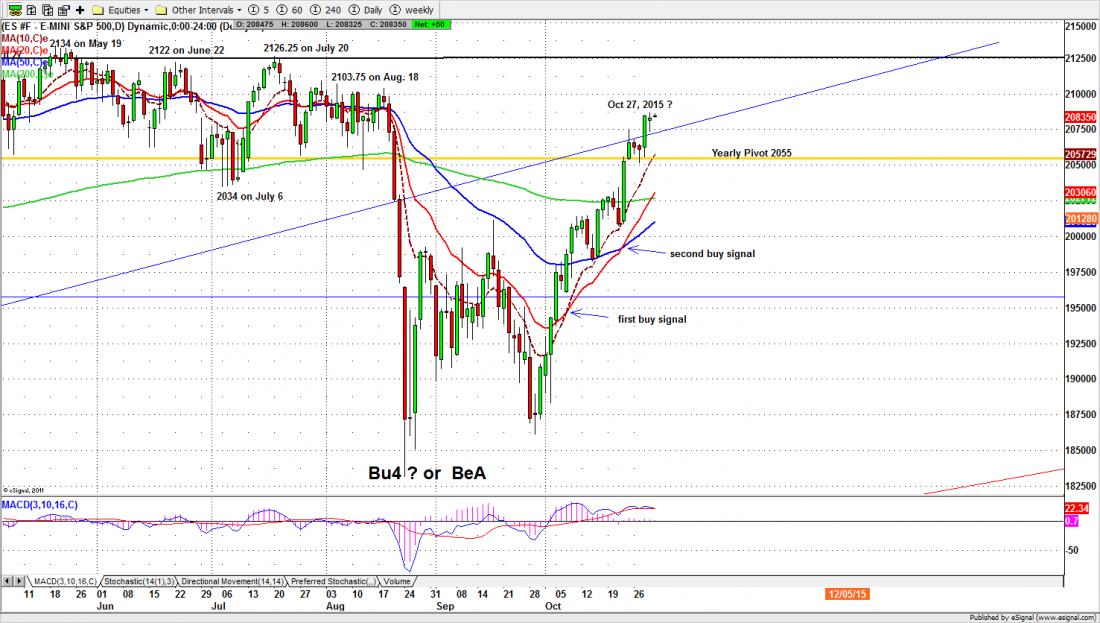

We don’t know what the closing price will be today. But overnight the cash index (SPX) was up about 170 points for the month; the S&P500 mini-futures were up almost 190 points.

There has never been a one-month rally of that size before; the closest was in March 2000, when the market gained 144 points.

What is even more remarkable is that this rocket to the moon occurred at a time when almost everything pointed to a crash, not a rally.

Economic data was generally bad. The percentage of Americans with a decent job was down, despite suspiciously optimistic official data.

GDP was down. Corporate earnings could only be described as “disappointing” by the most generous of commentators.

The international economic and political outlook was filled with risk. And the market had just suffered a waterfall crash that looked at the time like the beginning of a Bear.

So what happened?

There wasn’t any obvious reason for a record-breaking rally in October. The Fed and other central banks embarked on a campaign to talk the market up after the December crash, and as usual it was remarkably successful. A succession of dovish statements helped the futures levitate on nothing more than hot air.

But this has been the pattern for a year. There was nothing to mark October for special attention.

That led some commentators to the conclusion this wasn’t a reality-based rally so much as it was the mother of all short squeezes. When traders caught on the wrong side of the market are forced to liquidate their positions, the price move accelerates.

In the SPX, the short interest – the cumulative positions of traders who were short – was the highest it had been since 2008. As one commentator remarked: “either the market is poised for a crash, or … the biggest short squeeze in history.”

It may not have been the biggest in history, but it was a squeeze of massive proportions. In the futures, for example, any position traders who stayed short for the whole month were down about $9,500 per contract, and institutional traders would trading in 1,000 contract lots. There goes the bonus pool.

So what happens next?

The rally has been taking a small pause the last couple of days, but it is not done. The weekly options expire today, and the Bulls will try to push the futures up to 2095; the Bears to try for 2075.

Overhead is the psychology resistance line at 2100, and below there is the weekly pivot support at 2066 and the yearly pivot support at 2055. If/when the price reaches either of those levels, expect the buy-the-dip crowd to step in. That buy-the-dip mentality could continue most of next week.

Major support levels: 2005-02.75, 1992.5-87.50, 1950-56, 1928-29.50

Major resistance levels: 2088-89.50, 2099-2103, 2114.50-16.50

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/