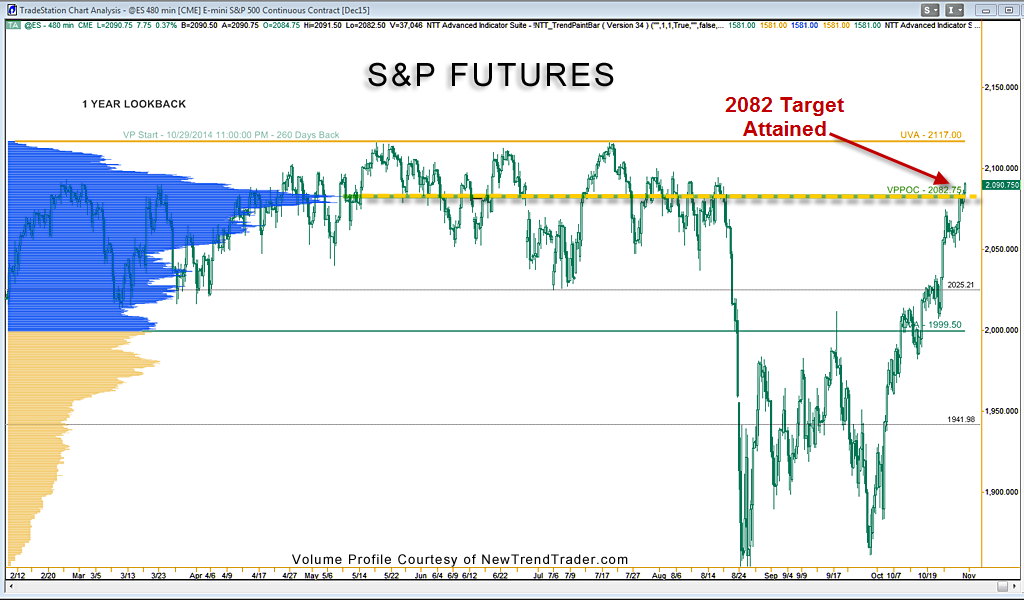

Over the last few weeks I’ve been following the S&P futures as they ambled toward my target of 2082 (see accompanying chart). 2082 is the Volume Profile Point of Control for a look-back of one year in the S&P futures, which is the price at which the highest volume over the last year occurred. It’s a target because price tends to be magnetized to areas where business was previously transacted.

I noted in last week’s article that last Thursday’s rally (due to news from the European Central Bank) marked the resumption of the move toward this target.

As I write this around 11 pm ET, the S&P Futures are trading at 2090, a modest overshoot. I had previously been concerned that due to the large High Volume Node at 2082 it was possible that this rally would mark the end of the 6-year bull.

Based on a review of the weekly and monthly charts of the S&P and the Nasdaq 100, which have barely wiggled over the last two months, I think the market will enjoy a Santa Claus rally starting now. With both the European CB and the Fed in a supportive role, and Apple (AAPL) on its way to $126, instead of a “Long Kiss Goodbye” to the bull market, we are more likely to Kiss and Make Up.

www.daytradingpsychology.com (for individual traders)

www.trader-analytics.com (for hedge funds and banks)