Point 27

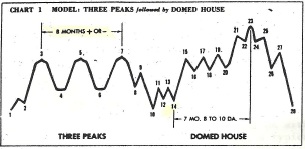

A six-month cycle pointed to an important low in Sept/Oct this year. A low then matches seasonal expectations for equities. If that low was point 26 on Lindsay’s template, then the rally into point 27 will be short as the right shoulder after the cupola (point 27) usually occurs at about five months or less after the cupola (point 23). From 1901 through 2011 there have been only three instances of a longer time frame between points 23 and 27.

As October is 5 months from the May high we would seem to be at the critical point (27) in the pattern. Of course, for the market to turn down during the 4Q it is fighting normal seasonality. But, as shown in past reports, seasonality in pre-election years differs from “normal” as it does between points J and M of Lindsay’s Long Cycle.

Once point 27 is passed, prices normally suffer the greater part of the remaining loss rapidly.

Get a trial subscription to Seattle Technical Advisors.