On November 3rd, Zynga released daily active user results for the third quarter, which was as bad as the market was pricing in over the last few months. Average daily active user were 19M, down 21% on a year over year basis (average MAU’s fell 27% to 75M). As the company struggles and gamers leave the $2B social game services provider (FarmVille, Words With Friends, Zynga Poker, etc.), management felt the need to make a change at the CFO role. David Lee will be departing on December 11th and replaced with interim CFO Michelle Quejado.

Along with the $5.9B buyout of rival King Digital (is ZNGA the next target?), there are a few other data points that are contributing to the breakout in the daily chart below. Despite the weak MAU’s, Zynga reported EPS of $0.00 vs the -$0.01 Wall Street estimate on revenue of $195.7M vs the $186.45M estimate (+10.8% from Q3 of 2014). Bookings of $176M came in above the high end of the company’s guidance; mobile bookings rose 26% to $121M. Arguably the biggest bright spot was the $200M share repurchase program that the board of directors authorized through October 2017 (potentially buying back 10% of the float).

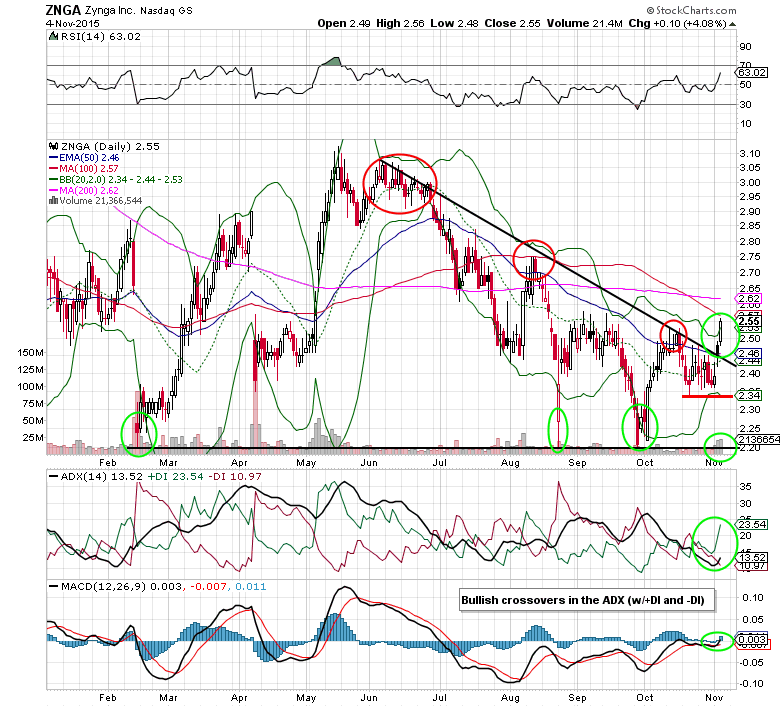

In September, shares of ZNGA put in their third successful test of the $2.20 support level in 9 months. Consequently, this led a breakout above the downtrend resistance line on heavy volume (corresponding with earnings). For those looking to get long the stock, a stop loss under the October 21st low of $2.34 puts total risk under 9%. Short interest of 25%+ could easily lead to a short covering rally back to $3+ by the end of the year; early 2016.

Zynga Options Trade Idea

Buy the Dec 18 $2.50 call for $0.15 or better

Stop loss- None

1st upside target- $0.30

2nd upside target- $0.45

Click here to learn more about Mitchell’s OptionsRiskManagement.com and the services he offers.