Gold: There’s something happening here. What it is ain’t exactly clear.

By Polly Dampier- Naturus.com

There’s something strange going on in the Gold market. We aren’t sure what it means, or how important it is, but it is puzzling. And troubling.

We trade gold futures on the Comex, a division of the Chicago Mercantile Exchange. The Comex provides the trading mechanisms that match buyers and sellers of futures contracts. It also provides a mechanism for delivering the physical gold bullion represented by those futures contracts, usually in the form of warehouse receipts, sometimes in the form of physical bullion.

(Those warehouse receipts can be treated more or less like bearer bonds. They can be bought and sold, and they are supposed to represent ownership of physical gold bullion held in vaults operated by five banks under the supervision of the exchange).

The regulations for storing gold through Comex are detailed and precise. It has to be moved in and out of the vault in a specific way, every movement has to be reported daily, and the process of assaying and weighing bullion is recorded down to a thousandth of a troy ounce.

But over a weekend in late October, J.P. Morgan Chase, added nine metric tonnes of bullion to its vaults, an enormous amount in comparison to normal practices and to the activity of other banks.

The gold was added to the “eligible” stash, which, despite the name, is not available for delivery to holders of warehouse receipts. Only “registered” gold – a much smaller amount – is available for delivery.

Now here’s the rub. The banks can move bullion from the “registered” – i.e. available for delivery – to the “eligible” classification as a book-keeping entry. And the amount of “registered” gold has been falling since 2013, and falling dramatically in the past few months.

Earlier this week it fell again, by about a third, to roughly 151,000 ounces, the lowest level ever. JP Morgan is showing only a little less than 11,000 ounces available for delivery.

But the open interest in futures contracts has been increasing.

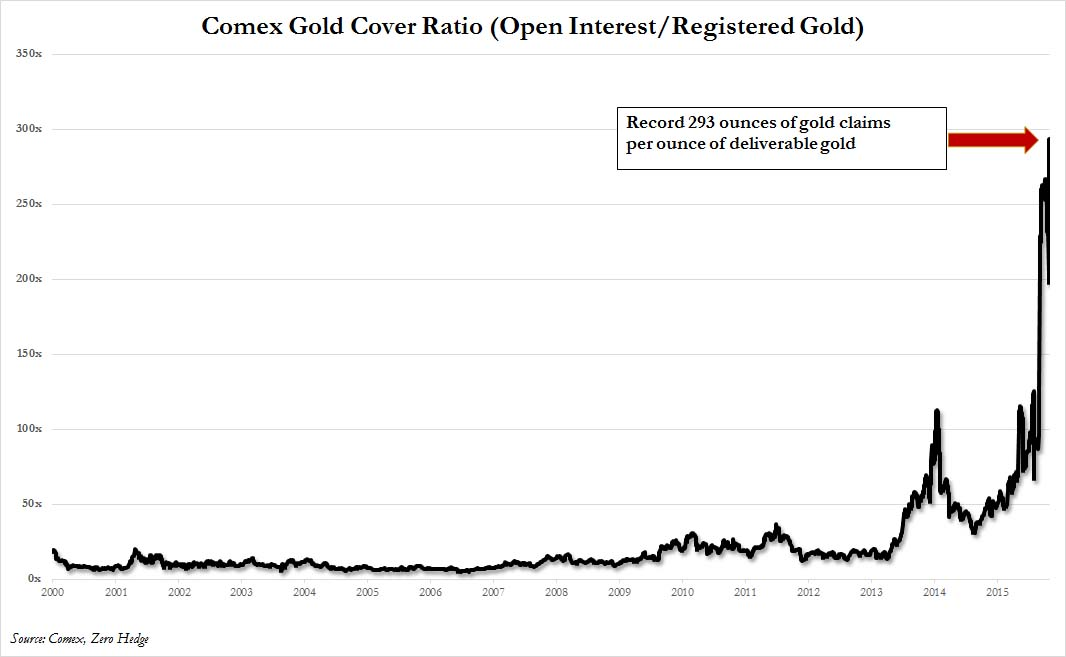

The result? For the Comex as a whole, there are now almost 300 potential claims for every ounce of gold in its vaults. Stated a little differently, the ratio of “paper” gold to the actual metal is now a bit less than 300 to 1. In 2013 it was below 25 to 1.

How important is that? We’re not sure. Like most traders of futures contracts we would never ask for delivery of the physical metal – you have to pay the cost of storing it – so most contracts are settled in cash.

But if even a very small percentage of contract holders decided to “stand for delivery” – as little as one per cent — the exchange would not be able to meet the demand with the present reserves.

Which kind of makes you wonder what exactly you are getting when you buy a gold contract.

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/

Chart: Comex gold coverage ratio. Chart courtesy ZeroHedge.com