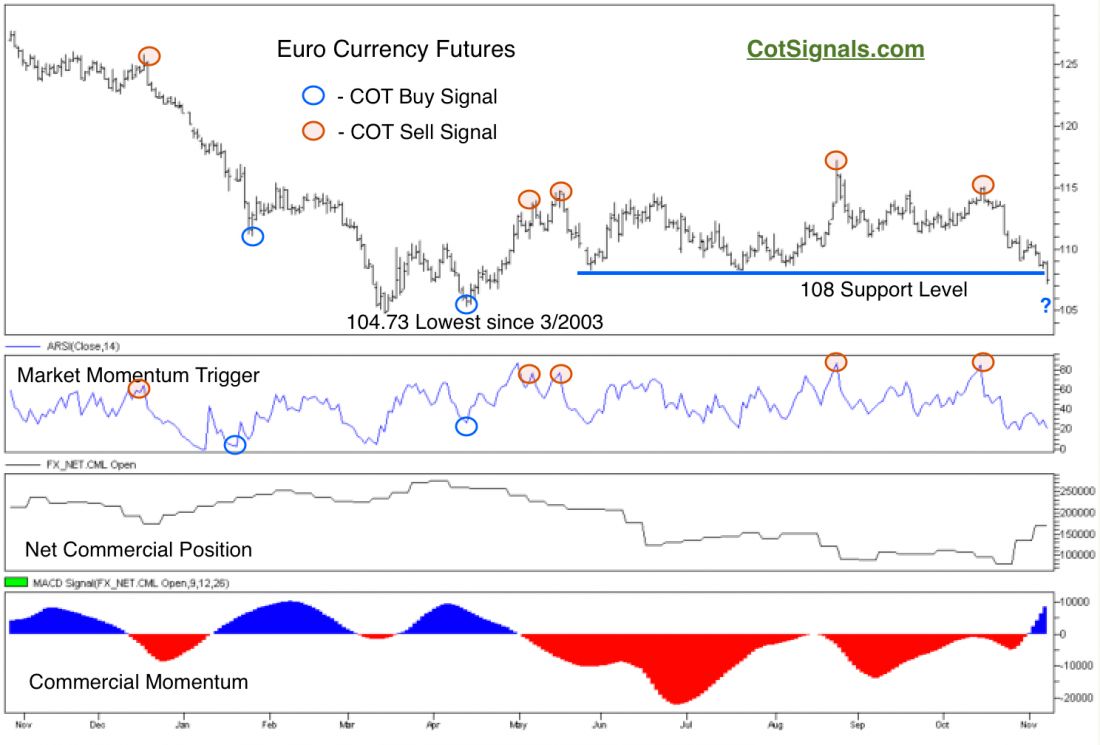

The US Dollar has been on a tear since mid-October and we’ve been fortunate enough to catch this as well as its ancillary moves, particularly the metals. Unfortunately, the only question I ever hear is, “What’s next?” Patience isn’t necessarily the strong suit of the retail trader but, for the disciplined, our adaptation of the Commitment of Traders report is very much a forward thinking process. The commercial traders are, “negative feedback” traders. Their models are based on buying declines or, selling rallies as a given market becomes under or, overvalued relative to certain time and price points. Given that these positions are reported to the Commodity Futures’ Trading Commission on a weekly basis, it allows us to track both their momentum and absolute values in order to determine their eagerness to act within the market. Their purchase of 90k+ contracts in the Euro currency in the last two weeks is extremely suggestive of a short trap bounce that trend traders should be aware of and swing traders should be watching closely.

Trend trading is one of the most popular and statistically verified trading methodologies. Historically, volatility expansion in the anticipated direction has been used as a classic entry signal because it works. One of the major drawbacks to this methodology is the large amount of capital placed at risk. This is because the market tends to bounce, rather than moving in one continuous direction. The bounce is the domain of the commercial trader. This is also the cause of the, “false breakout.” The Euro currency breached major support last week at 108. This would generally trigger a new wave of selling, as the market would be expected to push towards its low for the year around $1.0475. However, we don’t expect this to happen at least, not yet.

Confirmation of a volatility breakout should include increasing open interest as the market’s movement into new territory draws in fresh money. However, deeper analysis of the commercial trader position in conjunction with the CME Group’s open interest report reveals a different story. Yes open interest did increase by a little more than 5,000 contracts last week. However, this is due solely to the commercial buying previously referenced. Absent their purchases, open interest would’ve declined by more than 30,000 last week. Furthermore, the inclusion of options reveals a net decline of more than 100,000 contracts over the last week. Obviously, new sellers are not coming to market. Finally, commercial trader purchases have been strong enough to shift their momentum to the long side of this market for the first time since April. This is why Friday’s penetration of the $1.08 support is best viewed as a short-term buying opportunity.

The December Euro currency futures are currently oversold on a short-term market momentum basis in the face of an increasingly bullish commercial trader position. Clearly, they feel we are near value prices at this point in time and that their models do not justify additional selling and they do not expect this market to move to new territory but, return to whence it came. Finally, though the market is oversold, we won’t jump in and buy until it actually begins to turn higher. The old adage, “Never catch a falling knife” is always appropriate. Once the market bounces, we’ll issue an outright COT Buy signal and try to profit as the long positions become consolidated in the hands of the market’s strongest players. We believe the bounce is, “What’s next.”

Do you want to leveraget the resources of the world’s biggest commercial traders? CLICK HERE