Day trading stocks requires a good deal of technical knowledge, skill, and ability. Traders need to be able to read the market skillfully and select the right stocks to trade. Here is simple and effective way to select an appropriate stock to day trade when the market is expected to pull back from its overall trend.

Day Trading Stocks: Comparative Strength & Weakness

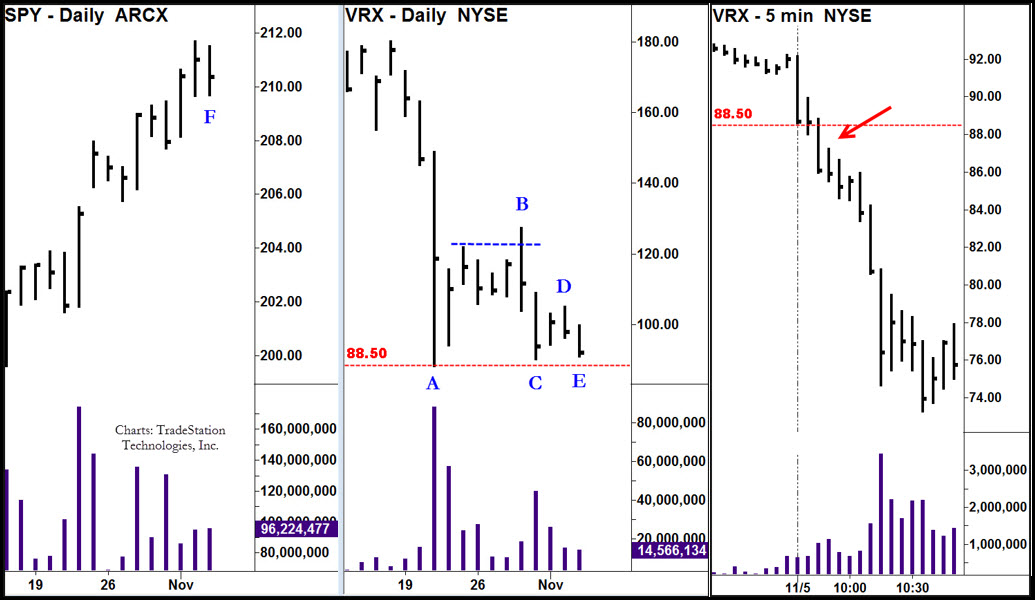

When trading stocks, we always want to assess a stock’s relative strength or weakness compared to other stocks. One way to do this is by a simple comparison with the overall market. This will tell us if the stock is stronger, weaker, or moving about the same as other stocks. We’ll use SPY, the S&P 500 ETF to represent the market.

As you can see from the charts, recent price action in SPY shows the overall market moving up strongly. This will not be true with all stocks. Some, like VRX, will be moving in the opposite direction. In fact, unlike SPY which has been in an uptrend since mid-August, VRX has been in a steady decline for the past several months. It came to a low at 88.50, painted about two weeks ago. Comparatively, this stock was significantly weaker than the market.

Day Trading Stocks: Recent Price & Volume

Recent activity also shows significant technical weakness. There has been little buying in VRX. We can see this in the daily price and volume. The market did find support at the 88.50 level for a day or two (A), but overall action since then has been poor. When it had a chance to rally above recent resistance (B) it was checked by supply and immediately reacted on strong, downside volume (C).

The last attempt to rally this stock (D) was feeble, occurring on very light volume and showing little ability on the part of buyers to step in at support and take control from sellers. The inability to rally off of support confirms the dominance of supply. The last day’s activity (E) closes on its low, further confirming the overall weakness in this stock. Sellers have the upper hand.

Day Trading Stocks: How to Do It

So, how do we use this information to our advantage? Although SPY was strongly up, the markets don’t move in a straight line. There are always pullbacks after a few days of rally. SPY closed at or under the previous two day’s closes (F), showing no net gain after three days of market action. This indicates the potential for a down day the next trading day. If the overall market is anticipated to be down, we can look to weaker stocks like VRX as candidates for short opportunities. Typically, down days in the overall market produce liquidation in weaker stocks.

Right after the open, VRX headed down with a vengeance, quickly breaking the 88.50 support level. Short sales on the intraday break (5-minute chart) produced an excellent trade, as the market never looked back.

Day trading stocks as well as the S&P e-minis and currencies are frequently covered on the author’s blog. The website also has free resources on trading the markets without indicators and trading psychology. You are invited for a visit.