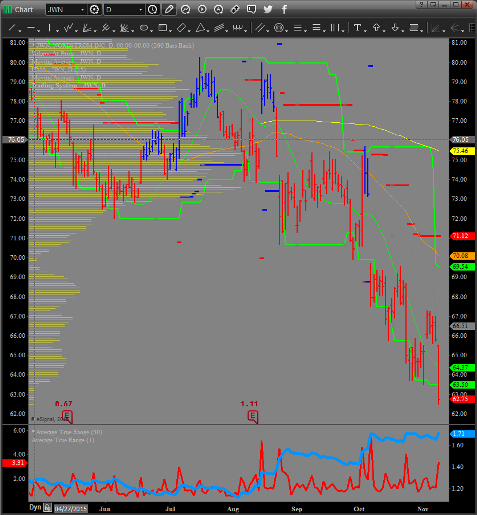

When you get scared you sell what you have. When you panic, you sell what you can. Often, the baby gets thrown out with the bathwater. This might just be the case with Nordstrom’s (JWN). The entire sector got pummeled Monday morning. Macy’s, J.C. Penney, Kohl’s, Dillard’s. Even Target, Costco and T.J. Maxx could not escape the sector’s wrath. All were down nearly 5%. If you take a look at JWN’s chart you can see that it’s sitting on 52-week lows:

If you look at JWN’s recent performance you will see that it’s actually gone up on earnings five out of the last six cycles. If I can identify an upside play with the proper reward to risk, it is certainly worth consideration. Through November’s expiration, the market is pricing in a move in the 8% – 10.75% range. This translates into a target range of $68.00 – $69.50. The November 62.65/67.65/70.15 broken-wing call butterfly is trading ~$1.35. This would afford us a max reward to risk of 2.70:1. This is the difference between the two first strikes less the $1.35 in premium paid, divided by 1.35. For my tolerances, anything North of 2.5:1 for a directional earnings play is proper risk.

Want a free lesson from Mike Shorr at Trading Advantage? Click here