News of the terrorist attacks in Paris on Friday hit US equity markets with about half an hour to go in the trading day. The S&P500 large-cap index had been attempting to climb back from a gap down open and an intraday sell-off when the first reports arrived. The index dropped another 15 points. It closed at 2023.04, down 76 points (3.6%) for the week.

Once the overnight trading opened Sunday night the market dropped another 15 points in the first hour, then recovered somewhat. So what impact will this have of US equities today?

Bloodshed and carnage are not good for equities – or anything else, really – but the impact of the Paris atrocity on US markets is likely to be limited. If there is a sharp sell-off it may not last. Here’s why.

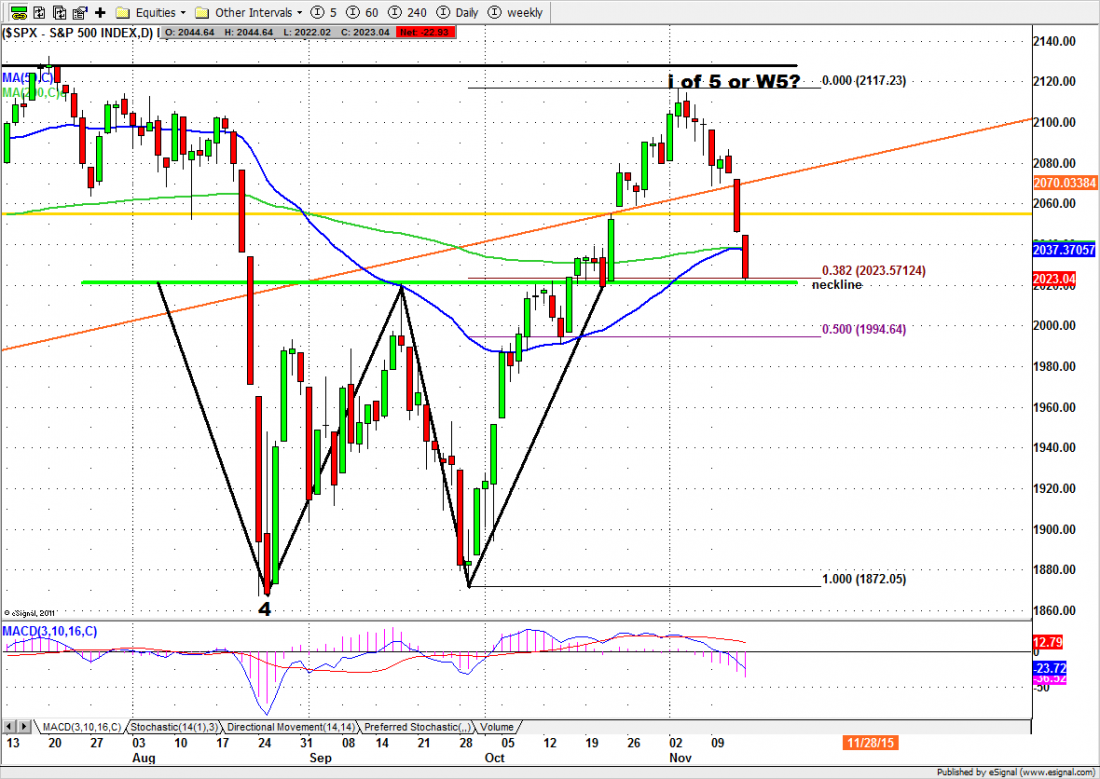

In a nutshell, no panic selling. From a technical perspective, the market decline stopped almost exactly at an important inflection point: the 38% Fibonacci retracement of the recent rally, and the neckline of the double bottom pattern that goes back to the August low (see chart). In technical analysis this is considered normal price behaviour. It won’t do any damage to the long-term trend, and it qualifies as a normal correction.

That doesn’t mean the market won’t go down from here. There are good technical reasons to believe it will. But if there is a sharp sell-off, we’ll be looking for the Plunge Protection Team to ride to the rescue. We don’t think the Fed will be willing to raise interest rates if the SPX gets much below 2020 and stays there. And we think they want a token rate increase in December.

Goldman Sachs and a slew of European banks share our view that the Paris attacks will not have a long-term impact on US markets. There will certainly be political fallout: some European political parties are already calling for a halt to immigration from Muslim countries, and Europe’s famously open borders may slam shut. The Euro will take a beating, but it was being beaten anyway. But this has happened before, in London and Madrid. It will pass, as it did before.

This week

We have the FOMC minutes on Wednesday and November option expiration on Friday, plus whatever overflow from French rage reaches our shore. There is liable to be a lot of chop this week.

The price levels we will be watching first are 2020 and 1995, Friday’s support area (and the September high) and the 50% Fib retracement of the recent rally. If the price falls below the current support level, then 2000-1995 is likely to be the first place it may stop. If it falls below 1995, the next Fib area is 1965, and there is an unfilled gap at 1950, left behind in October’s mad dash up.

Friday the price broke down through the four-year uptrend line (again) and closed below the 200-day and 50-day moving average lines. The loss of those major support areas means that rallies are likely to be used by trapped buyers as an opportunity to get out … which will work to hold the price down.

If the market does struggle back above 2038-37 (the 200/50 ema’s) it may be able to bounce up to 2050. We have a short-term oversold condition, and that could generate a little bounce. But the SPX is now negative for the year; getting back into the green candles will be difficult.

Today

The S&P500 mini-futures (ES) gapped down Friday, broke the 200/50-day moving averages and closed near the low of the day. The downside price action was strong, and it gives a bearish outlook for today.

We may see a little oversold bounce today, especially if the Plunge Protection Team shows up. 2012-08 is the neckline for the double bottom pattern. If it holds, ES could bounce up to retest Friday’s high (2038-39) or the 2045-50 area.

If the support doesn’t hold, the next Fib retracement levels at 1986 and 1956 may be in play.

Major support levels for Monday: 2001-03, 1995.50-92.25, 1975-72, 1950-56, 1929-33.25

Major resistance levels: 2103.75-02.50, 2114.50-16.50, 2134-35.50

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/