In tactical trading one is always looking for failures. Specifically, a failure to do something that the market should do if the trend is up or down or changing. We had just such a failure this week and it has very bullish implications.

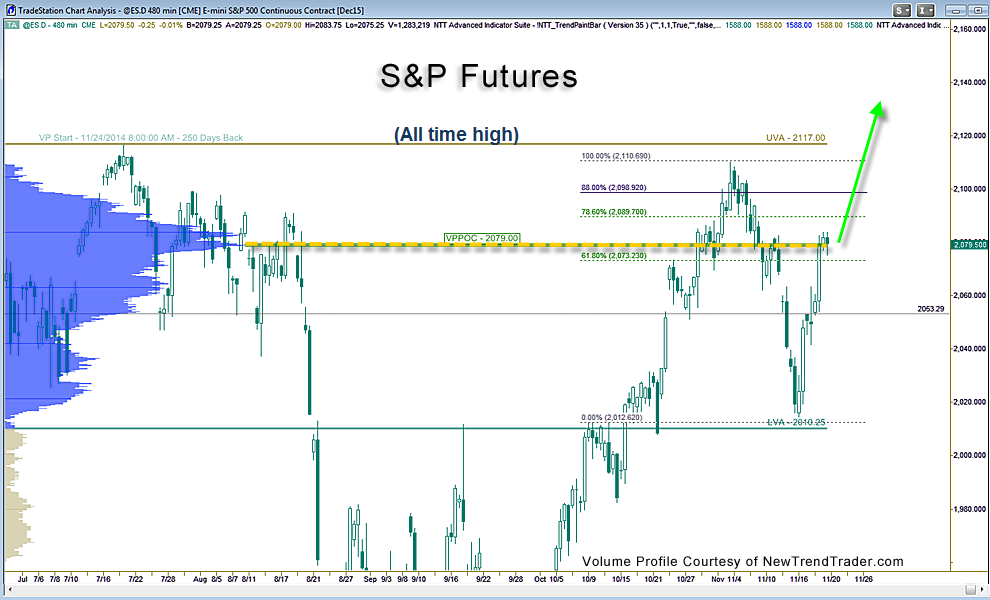

Before the open on Monday (11/16) I noted that the S&P had “important support” at the Lower Value Area (2011), the dark green line on the accompanying chart and I forecast a “decent” bounce. I must admit I did not anticipate the strength of the rally off that line in the sand.

Within 4 days the index is now back at its Volume Profile Point of Control… 2079. This is the high volume shelf that was violated last week, which caused almost a 100-point drop. But like Wiley Coyote, this market is hard to kill. It fell off a cliff and bounced right back; a very significant show of strength. So in my book this week marks the abject failure of the bears.

Meanwhile investor sentiment is cautious. Bulls and Bears are both at 30% and 38% of AAII subscribers are neutral on market prospects. This is the perfect sentiment setup for a surprise rally that will convert the neutrals to bulls.

Therefore, I’m looking for the S&P 500 to breakout to new all-time highs before the end of the year (maybe before the end of November) and for the Nasdaq 100 tracking stock (QQQ) to make a blistering run past its all-time closing high and reach 126 by December 31st. This would represent a 10% gain from current levels. (By the way, I expect this equity surge to coincide with gold dropping well below $1000/oz.)

Oh, and just one more prediction. I expect 2016 to be a lousy year for stocks.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)