Wednesday we gave you a list of five things highlight the difference between the soaring stock market and the sagging real economy. Well here’s one more: the industrial companies that manufacture the heavy equipment the world uses to build stuff are in deep, deep trouble.

We have long argued that the world has already entered an industrial recession; the companies that actually make things – as compared to the companies that move money or pixels around – are wounded and staggering.

Nobody demonstrates that better than the two heavyweights who manufacture a large part of the heavy equipment used everywhere in the world: Caterpillar and Komatsu.

Both are important industrial companies in their own right. If Caterpillar ever went bust, the city of Peoria Illinois would become a ghost town in a week. Caterpillar employs so many people there it is virtually the only game in town.

But it isn’t just the jobs that would be lost if the giants stumble. Their dismal sales results are a sign that everywhere in the world, the building and operation of large-scale development projects is grinding to a halt.

You can’t build a mine or a highway or an airport without using the heavy equipment these two companies make. But if you aren’t building those things – or any other substantial infrastructure – the demand for that equipment drops dead. And that is exactly what has happened.

Komatsu, the Japanese conglomerate, has seen sales of its seven major equipment types decline in every region of the world, except for the Middle East, a relatively small part of its market.

In the large market areas, Southeast Asia and especially China, year-over-year sales fell by 24% and 48% respectively in August, a continuation of the trend throughout 2015.

Even in its home market, Japan, August sales were down 30%

If anything, Caterpillar is worse. The company released its latest retail sales figures yesterday, and the results were worse than previous results … and the previous results were pretty bad to begin with.

Caterpillar has shown declining global retail sales for 35 consecutive months, but the latest returns are even worse. Global retail sales are down 16%, the worst annual result since 2010. Sales in Asia/Pacific (mainly China) are down 26%; in Latin America the decline is 36%. Even US sales are down eight per cent.

Worse, there is evidence Caterpillar has been financing sales of its equipment, and holding the paper itself. That causes two headaches: if/when their struggling customers default on the payments, Caterpillar will get stuck with the bad debt. And when bankrupt customers sell off their equipment, they will flood the market with used bulldozers at fire-sale prices – making it even tougher to sell high-priced new gear.

All of this stuff is connected. The failure of wages to rise much from 1973 levels cripples retail spending. Stores that see declining sales don’t build new shopping centres. Depressing the price of gold and other commodities reduces the demand for mining equipment, so Caterpillar sells fewer dump trucks and bulldozers, and residential real estate in Peoria begins to look like a high-risk proposition.

Whatever else, it doesn’t look like an economy teetering on the brink of “lift-off,” the new buzz-word of the chattering class.

So after nine years of cheap money (the Fed hasn’t raised rates since 2006) and roughly $13 trillion in Quantitative Easing, the only tangible result is a stock market that has more than tripled in value from the lows of the financial crisis, but which is increasingly disconnected from a real economy that badly needs repair.

That’s terrific for the wealthiest 10% of Americans, who own 81% of market assets. What do the rest of us get?

Today

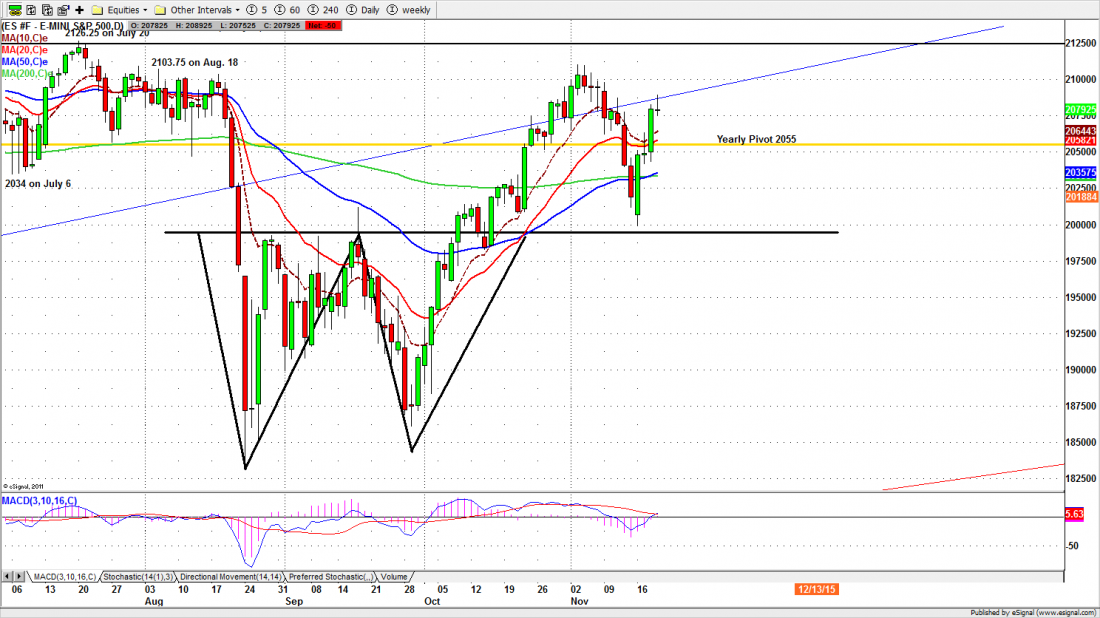

Major support levels for Thursday: 2050-45, 2030.50-32.50, 2021.50-23.75;

Major resistance levels: 2097-95, 2114.50-16.50

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/

Chart: ESZ5 mini-futures. Daily chart to Nov. 19, 2015