This week, we’ll focus on the primary metal futures contracts, as a group. It’s been nothing but bad news in the metals since the late summer lows, of which, all but one market has since penetrated. The recent declines from just last month’s highs all exceed 10% with platinum having fallen the furthest at more than 17%. We’ve included charts on copper, silver, platinum and gold as textbook examples of the cycles the commercial traders play and how this translates into trading opportunities at the retail level, concluding with a head’s up towards a classic short trap currently setting up.

The metals markets as a whole have been in a broad decline that accelerated through this summer. It’s important to remember that all of these markets have been in stuck in a cycle of decline and base since making their all-time highs in 2011 except for platinum, which peaked in 2008. Commercial traders are value players. Their businesses are based on the accurate forecasting of the metals they mine or, use. The weekly Commitment of Traders report tabulates their actions as a whole which we then distill down to their net position which you see calculated in the second pane of the included charts.

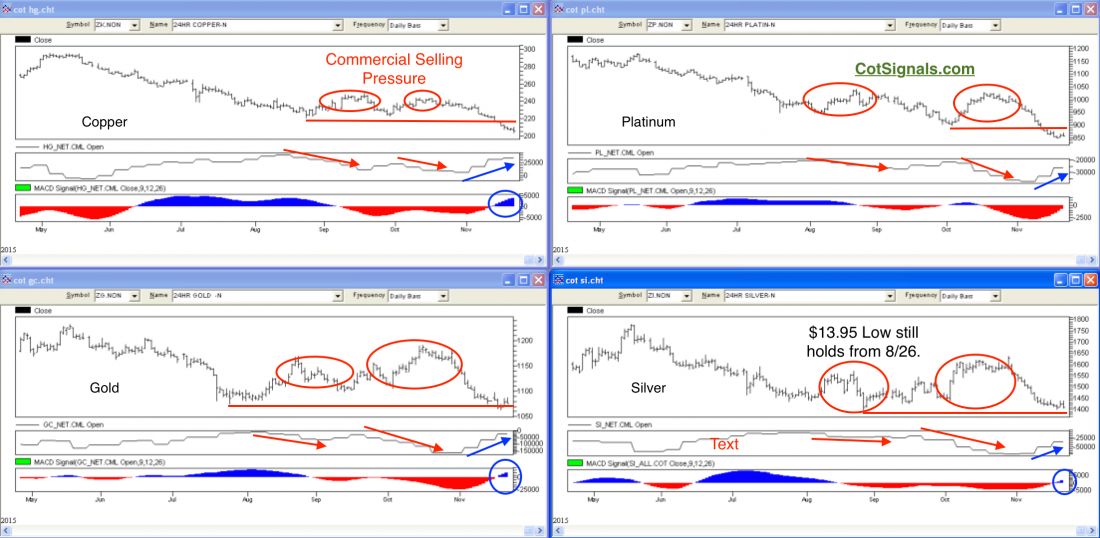

The decline of the metal markets puts the commercial miners on edge as they try to estimate their expected revenues based on their production at current and anticipated market prices. Notice the, “Commercial Selling Pressure” in the first chart. You can see that miners have capped both attempted rallies off the summer and October lows, across all four markets. Conversely, you can see that commercial end users aren’t rushing in to buy until these markets ratchet down to new lows hence, the mid-summer’s shift to positive commercial trader momentum in the bottom panes of the included charts. Also note that of the four markets, silver has not penetrated its August low at $13.95 per ounce.

The recent lows in copper, silver, platinum and gold have come near solid technical support. Not to mention, one of the primary detriments to the metals markets has been the recent rally of the U.S. Dollar on which, commercial traders have just started to become negative towards. We think this combination, along with other factors may allow the metals markets to put in a bottom worth buying. Most interesting to us given the current state of things is the silver market. It has long been our thesis that the market will move in such a way as to cause the greatest harm to the greatest number of participants at the market’s most important moments. Translated to our current situation, it wouldn’t surprise us one bit to see the silver market finally fall through $13.95 per ounce prior to reversing higher in the near-term.

Whether silver provides us with the abrupt about face we’ve described or not, the bigger picture clearly shows commercial end users in the metal markets actively purchasing forward supplies as they take advantage of low prices not seen in years. Therefore, we’ll start nibbling on the buy side and look for new found support to hold.

Do you want to leveraget the resources of the world’s biggest commercial traders? CLICK HERE