The S&P500, the index that measures the health of the largest US companies, had its best week of the year last week. It closed Friday at 2089.17, up 66.13 points for the week, a 3.26% gain. Pretty good.

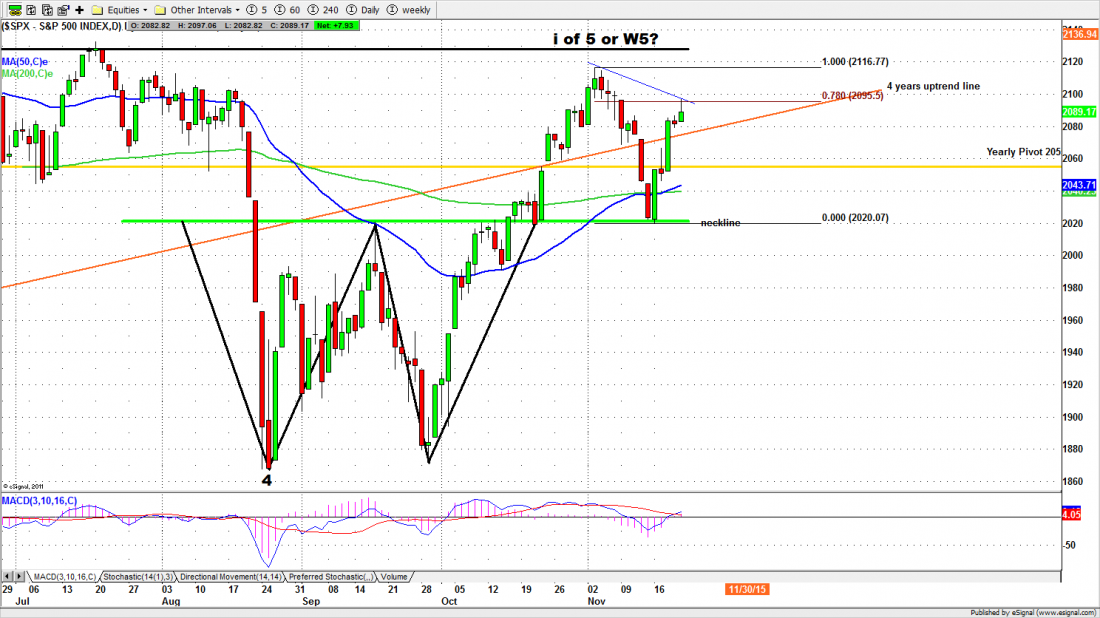

But before you break out the pom-poms, that positive performance followed the second-worst week of the year. The market recovered the losses, but it is really just going sideways. Since the October rally made its peak, the large cap index has been stalled by resistance around 2095. For the last two weeks the high-water mark has been 2097.06

Many traders are surprised it is holding up so well. And oddly enough it may be the Fed’s threats of a rate hike in December that is helping keep the S&P afloat.

Normally the prospect of an interest rate increase sends the market sliding down, down, down. And that may still happen this time.

But one effect of the Fed’s hawkish tone is to induce foreign investors to move assets into the US dollar, particularly at a time when the whole world outside the US is engaged in competitive currency devaluations.

The US dollar, in contrast to almost every other currency, has been getting stronger. A year ago this summer, the US dollar index (which measures the USD against a basket of other world currencies) was trading just above 80.00; last night it was trading at 99.88.

So the Euro, which was trading at about 1.25 a year ago, was trading last week at 1.06. The Canadian dollar, which was trading at par with the US dollar in 2014, is now trading at $0.75, which means. US tourists in Canada get about $1.33 CDN for every USD.

The combination of devaluing foreign currencies and a strengthening US dollar is driving foreign assets into the USD … and in large part that money flows into US financial assets. Where else can hot money go?

That’s a mixed blessing, because it makes it more difficult for US companies to sell goods and services to foreigners. (One of the things they do in response is outsource a lot of jobs that used to live in the United States. You can one example in the flight of US manufacturing jobs overseas).

With the Fed now promising higher interest rates for dollar-denominated financial instruments, the money flow into the US is only getting stronger. And it’s that flow, together with other factors, is helping keep stocks and bonds above water.

This week

With the market closed for the Thanksgiving holiday on Thursday, and only open for half a day on Friday, it is going to be strange week. A lot of traders will take off Wednesday around noon, and not show up again until the following Monday. While the big cats are away, there will be lots of opportunity for mischief.

We also have the Fundies starting to think about their year-end bonuses, and looking for ways to goose the market into the year end. The SPX has been essentially flat for all of 2015; time to improve reality a little.

Last week the SPX halted its decline almost exactly at the 38% Fibonacci retracement and moved back to the previous resistance. That is textbook stuff, and we’d normally expect a breakout move higher to follow. But before the index confirms a short-term breakout, we’re expecting either a sideways crawl or a small pullback, especially in a week with essentially only three days to trade. Mind you, those three days may be hectic.

Today

Friday the ES had a gap up at open and managed to hold above the gap for closing – barely. It closed 1.75 points above the regular session open.

Today the four-year uptrend will be the key line to watch. A move above 2095.50 is likely to push ES higher to challenge the November monthly high near 2110.25. A failure to move above 2095.50 could lead the ES to repeat last Friday’s range or move lower to fill the remaining gap at 2079.25. We expect traders to “buy the dips” this week.

Major support levels for Monday: 2001-03, 1995.50-92.25, 1975-72, 1950-56, 1929-33.25

Major resistance levels: 2103.75-02.50, 2114.50-16.50, 2134-35.50

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/