Until very recently, the Biotech sector was the most energetic engine behind the Nasdaq bull market. Over the last few months, however, it has been notably lagging. Sectors get ahead of themselves as investors and traders chase momentum, which is why Biotech has fallen into a mini-bear market. The Nasdaq Biotech ETF (IBB), my proxy for the sector, has taken a 20-25% haircut from the all-time highs posted in July.

Of course, given its huge multi-year run-up, this down-draft is potentially nothing more than a prelude to a much larger decline and I’ve been concerned about that.

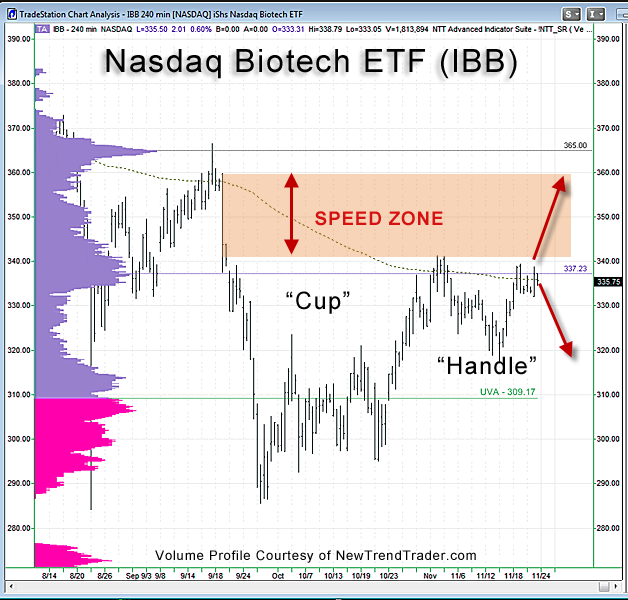

In early November, IBB rallied up to the area circled in blue, around 340. At that point I believe the market’s fate hung in the balance, but a down-side denouement never happened.

Instead of succumbing to the bear’s clawback, the ETF has printed a potential reversal pattern: the ‘cup and handle’ configuration favored by William O’Neil. This is an interesting and potentially bullish development.

Given the speed-zone just above current prices, if IBB breaks out it would move quickly to the $360 level and bring the rest of the 4-letter market with it. So, if you are wondering about a Santa Claus rally, keep an eye on IBB.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)