Holiday trading is hard. Domestic market closures and shortened trading sessions due to our own holidays can create choppy trading conditions and significant price gaps from one close to the next open. Furthermore, the current news cycle only worsens these conditions as domestically traded markets become influenced by the world’s pent up need to act in the face of the stories being run. Frankly, the only advantage I’ve ever really had during holiday trading was less competition among the local traders in the S&P 500 pit which I gladly took advantage of as a rookie trader. Twenty plus years later and I’ve found that there are two edges still to be had in holiday markets. Day trading works due to the expanded volatility and the short-term nature of the positions. Swing trading can also work if you’re patient and are willing to step in when it looks like everyone else is stepping out. We’ll focus on a swing trading opportunity in the March wheat contract for today’s piece.

Trading during holiday markets requires putting the odds on your side as much as possible. Today, we’ll look at technical analysis and the potential for volatility expansion within the context of a strong seasonal period for Chicago Board of Trade wheat futures. There’s a lot of information on the chart below, so let’s dive right in.

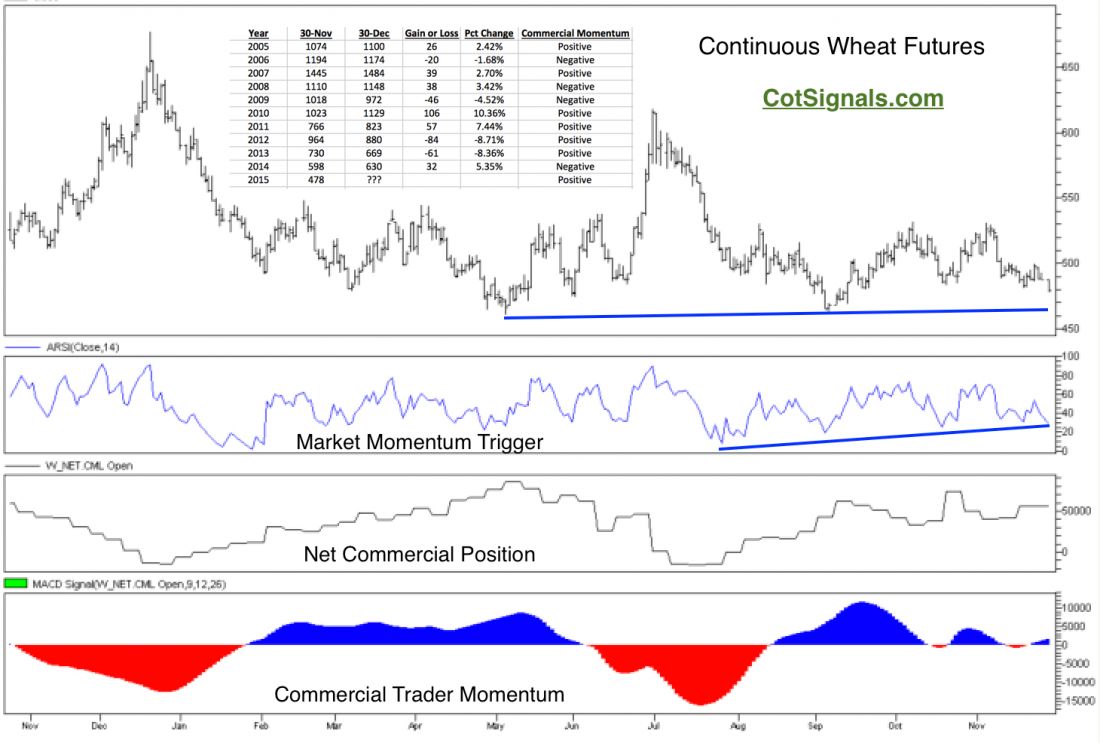

Beginning with the big picture, seasonal analysis shows that there is a significant bias to the upside between November 30th and December 30th. The table inserted into the chart shows the last ten years’ worth of data. Wheat was higher in 6 out of the last ten years during this period. However, if we only buy when the commercial traders are also buying during this period, we eliminate two more of the losing trades while also missing one winner for a final tally of five wins and two losses. Our core thesis of trading is based on the value discovery afforded by the commercial traders’ actions relative to price movement. Therefore, the current situation has peaked our interest.

Moving to the market itself, notice that it has been bouncing along its lows. A longer term chart would show this as pressuring the 2010 lows all the way down to $4.25 per bushel, clearly a ways lower from our current close of $4.79. Shifting this to a holiday trading perspective, here’s how we are watching it. We expect that wheat may very well fall through the trend line on both price and market momentum, panes one and two of the enclosed chart, respectively. Holiday trading would dictate that this would be some type of quick washout as the market falls and quickly rebounds. The market’s quick rebound would most likely create some type of bullish divergence pattern between market price and momentum. This is exactly the type of setup we like buying into. We’ll use whatever the swing low turns out to be as our protective stop. We’ll also re-evaluate this trade if the commercial traders’ momentum in pane three becomes negative. The average move for this trade has been higher by $.87 per bushel through the one month period. If we can buy into this type of strength at a discount, so much the better.

For Actionable Trade Strategies, Learn more at Cotsignals.com