Everybody knows what happened to Greece. The cradle of democracy drowned in debt, and now is suffering under an outsider-imposed austerity regimen that has driven unemployment up and the economy down, while the citizens suffer.

Now something similar is happening to Puerto Rico, America’s last official colony. On Tuesday (Dec. 1) the governor of Puerto Rico appeared before the Senate Judiciary Committee to explain the island’s predicament and beg for help. The problem, in one sentence, is that Puerto Rico has borrowed a bucketload of money, and now can’t afford to keep up the payments.

The governor, Alejandro Garcia Padilla, has said the island’s debt is unpayable. That is something of an understatement. Puerto Rico, with a population of 3.6 million, has a public debt with a face value of about $72 billion – more debt per capita than any state, including that poster child for profligacy, Massachusetts – plus another $43 billion in payments owed or promised to the government pension system.

That is about eight times the value of debt owed by the city of Detroit … just before Detroit went bankrupt.

Puerto Rico doesn’t have that option. As a territory – officially a ‘Commonwealth’ – it doesn’t have access to bankruptcy as a way of managing its otherwise unmanageable debt.

What it wants is a bail-out from the US, or at least legislation that will make it easier to negotiate with its creditors who are becoming restless. The Commonwealth has itself passed laws that allow its public corporations – the electricity authority, the highways and transportation agency, and others – to skip debt-service payments.

In June Puerto Rico missed a $416 million payment of bonds issued by its electricity company, amid talk of deferring repayments for five years.

The problem is that most of Puerto Rico’s debt has been sold through the US municipal bond market, and is owned by US based investors – including you, if you have money in a bond-based mutual fund.

On Tuesday, as the governor was testifying to the Senate committee, Puerto Rico came up with a $354 million payment due on its general obligation government bonds. But that payment looks like the last gasp. The government is literally out of money, and has instituted a series of measures to withhold payments from its suppliers in order to get operating cash. Meanwhile, another $303 million payment is due in 30 days.

As in Greece, there are hedge funds involved, and as in Greece, they are generously trying to arrange more favourable repayment terms… and perhaps even more loans to help Puerto Rico meet current obligations.

If you think that is an act of Christian charity on their part, I’d like to interest you in a little gold mining stock we own. For the most part they are so-called ‘vulture funds’ which bought the bonds at a sharp discount when more prudent investors – including your mutual fund, if you’re lucky – got out.

Unlike Greece, Puerto Rico is trying not to go deeper into the hole. Creditors must “share the sacrifice,” Governor Garcia Padilla told the New York Times last summer. More borrowing “will [just] kick the can. I am not kicking the can.”

As always, the basic question is who is going to get shafted. In Greece, the creditors (mainly German and French banks) were saved at the expense of the population. It remains to be seen if that will also happen in Puerto Rico. The size of the debt to be restructured is larger than anything ever attempted in the US, and nobody can predict what will happen.

But in any case, the muni bond market will never again be the safe, tranquil, uninteresting little backwater it used to be before governments and government entities started going broke. Maybe you should check your mutual funds.

Today

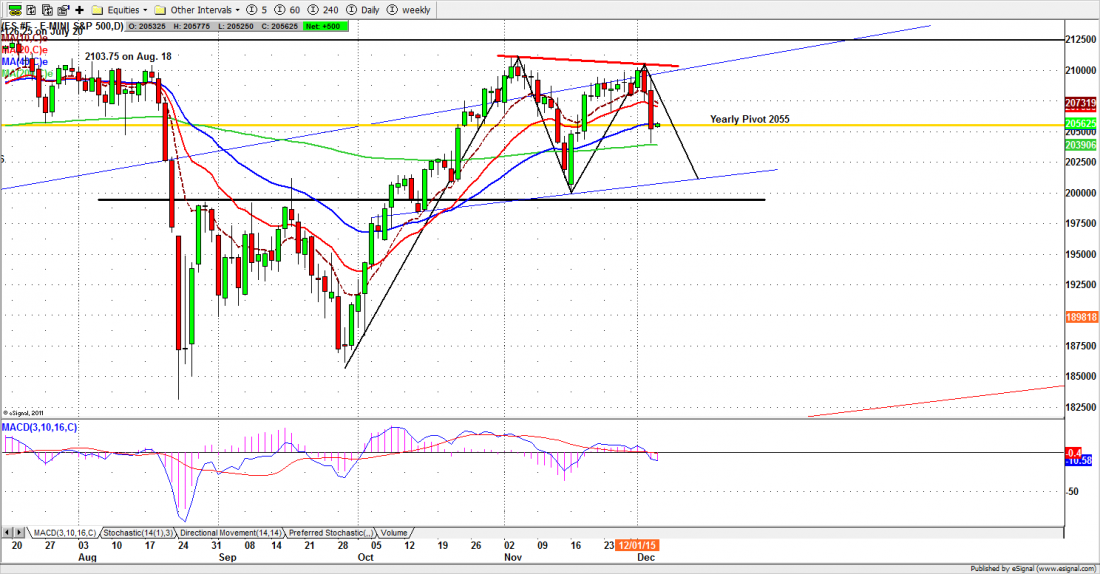

The S&P500 mini-futures (ESZ5) have crashed 70 points in the past two days – the current contract closed at 2051.25 on Thursday – and that has taken a lot of the shine off the November rally.

The most important predictable event today will be the non-farm payrolls before the market opens. Traders will be watching to see if they repeat the good news of last month, and if that will strengthen the Fed’s resolve to increase interest rates this month.

Major support levels: 2050-45, 2030.50-32.50, 2019.50-22.50

Major resistance levels: 2088-89.50 2105-08, 2114.50-16.50, 2121-23.50

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/

Chart: ESZ5 Daily chart Dec. 3, 2015