Call Selling is Ideal Profit Strategy in Pro-longed Bear Markets

With the latest media focus on oil prices and volatile stocks, a market that’s been largely out of the news – primarily because of it’s slow, discouraging (to bulls) descent is Gold. Slow, lackluster markets are rarely fodder for media or investor attention. But for option sellers, these kinds of markets can present an ideal situation.

This week’s feature will explain how you can potentially take profits out of the consistent, (and likely to continue) slide in Gold prices.

The Gold in Gold Bugs

The great thing about gold for option sellers is that there will always be gold bugs. No matter what the markets do, what the economy is like, what the geo-political situation, to gold bugs, it’s always a good time to be buying gold. Companies that peddle gold coins and gold bullion do a good job of convincing the public of this idea.

Gold typically performs best in times of inflation or a weak dollar. It can also be a safe haven investment in times of uncertainty. The keyword here is can be. Many will argue we are in times of great uncertainty. Maybe so. But one thing not uncertain is the strength of the dollar. And while global investors used to flock to gold in times of anxiety, this time around, they’re flocking to US treasuries and the US Dollar for safety. This puts further pressure on gold. Gold bugs, however, disregard this reality. This “always bullish” mentality is what keeps healthy premium in gold calls available much of the time.

Super Dollar

While the rest of the world struggles with stagnant or slowing growth and outright recession and acts to add stimulus to their economies, the US is expected to raise interest rates this month. The US recovery, while sloppy and underwhelming, has still been enough to make us the best of the worst vs the rest of the world. Thus, the dollar has strengthened against other major currencies. The markets have been expecting the Fed to raise rates for months now. The fact that it hasn’t happened yet has not hampered the dollar’s ascent. Some argue that the Fed actually pulling the trigger this month could be a case of buy the rumor, sell the fact.

We don’t think so. While a rate increase could bring some profit taking from dollar longs, it’s hard to see a US rate increase as anything but longer term bullish for the dollar. Should the Fed back off in December, the expectation will likely be for the increase to come in early 16.’ Thus, either way, the longer term forces driving the dollar don’t look to reverse dramatically any time soon.

The US economy is expected to grow by 2.8% in 2016 while inflation is projected to rise only slightly to 2.3% by end of 2016 as opposed to a paltry 1.2% for 2015 (*source: Kiplingers.com). This does not paint an inflationary environment for gold.

Trend still your Friend

Dollar bears argue that the market could be approaching a top. But the global economy doesn’t suggest so much.

US Dollar (Monthly)

US Dollar monthly chart is displaying a classic “cup and handle” formation.

Nor does the monthly chart.

The monthly US dollar chart (above) seems to be reflecting a classic William O’Neil “cup and handle” formation. If Mr. O’Neil’s forecasting model is correct, a substantial move higher in the dollar could be on the way.

Solid Downtrend in Gold

The end result of Dollar strength and the global “risk off” vibe towards asset purchases? A stubborn downtrend in gold since 2012. And while limited rallies are to be expected, this overall trend seems likely to continue.

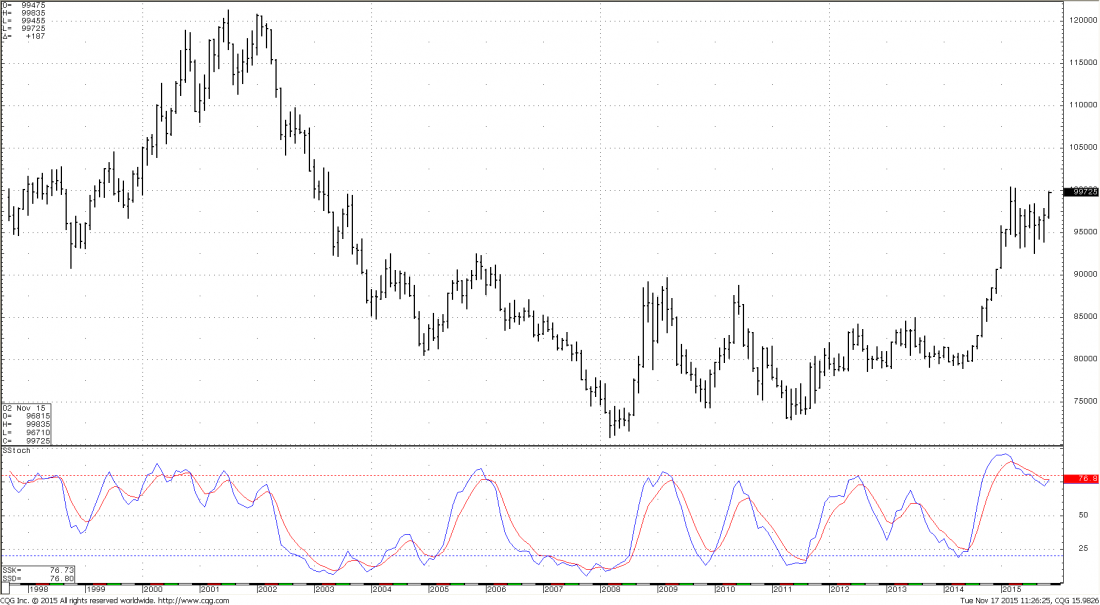

Weekly Gold

Weekly chart shows gold entrenched in a stubborn downtrend since 2012. The economics of gold make this trend likely to continue.

Monthly gold charts look even more ominous for bulls. November saw prices break below major support set in June.

Monthly Gold

Gold prices have broken below major support on the monthly chart.

Conclusion and Strategy

While gold will continue to have technical corrections, the there does not seem to be an impetus for a major trend change in Gold in the immediate future. Yet the public interest in gold always seems to keep attractive call premiums available in this market. We’ll view any strength in gold prices this month as call selling opportunities. Deep out of the money strikes in June Gold would seem to offer the best opportunities at this time. We’ll be working on selecting optimum strikes for managed client accounts in the coming weeks.

= = =

James Cordier is the author of McGraw-Hills The Complete Guide to Option Selling, 1st, 2nd and 3rd Editions. He is also founder and president of OptionSellers.com, an investment firm specializing in writing commodities options for high net-worth investors. To learn more about targeting outsized returns and real diversification through writing commodities options, request your copy of our free GUIDE TO SELLING OPTIONS for high net worth investors. Request your copy Now at www.OptionSellers.com/Solution