Technicians typically look for signs of excess bullishness or bearishness in sentiment polls to conclude markets have swung too far in one direction or the other. An extreme in bullishness is often followed by a decline in equities and an extreme in bearishness is often followed by a rally.

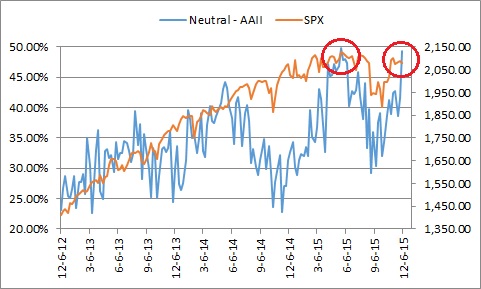

This year the American Association of Individual Investors poll showed an extreme in neutral sentiment (blue line) at the May high in the S&P 500 (orange line). Last week, neutral sentiment returned to the same level that marked the high in equities last May. It’s unusual to see such a high level of neutral sentiment. It’s as if there is loads of “sentiment” sitting on the sidelines waiting to become bearish or bullish. Last May, investors turned bearish. What happens this time should soon become known.

Click here to get your copy of the December Lindsay Report.