Last week I suggested that the market needed some bad news in order to set up a Santa Claus rally. The tepid QE announcement from the ECB on Thursday was just the ticket needed to catalyze the necessary sell off.

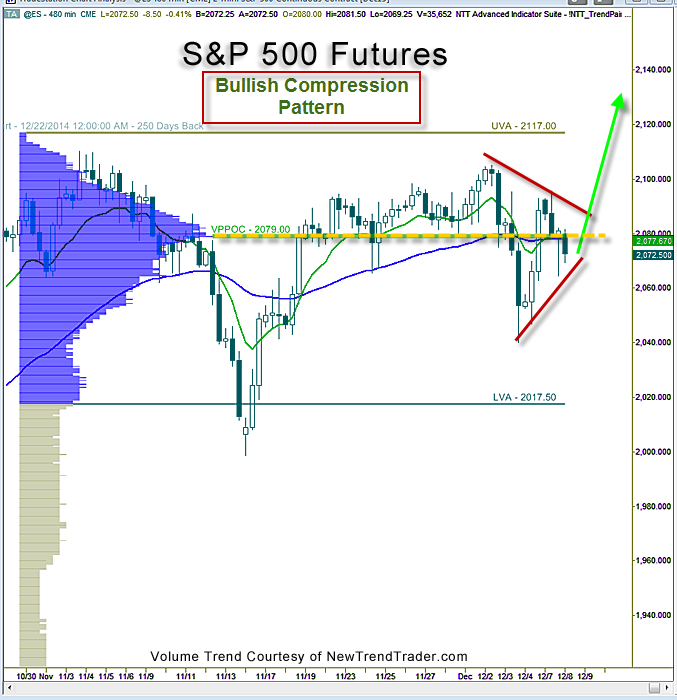

Thursday’s rapid decline broke the S&P 500 below a key ledge of volume support that is absolutely key for this market: the Volume Profile Point of Control (currently 2079). It’s the level of highest volume for a particular look-back period and acts like a floor or a ceiling. This level has been formed by over a year of trading and the breakdown ran stops that have been in place that long. Thus, the high volume.

Friday’s yoyo rebound, however, closed the S&P back above 2082. This appeared to be an affirmative rejection of lower prices. But then on Monday we had another test to the downside, albeit of less intensity and duration. That’s a good sign.

After all the sturm and drang, we are left with a compression pattern (red lines) that typically resolves in the direction of the existing trend, which is up.

In other words, I bet Santa is in the house.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)