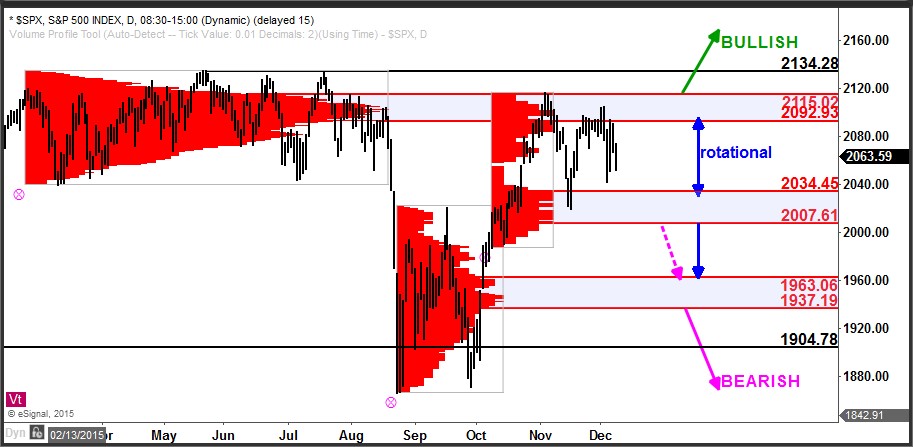

The S&P 500 remains in an area where I anticipate two-sided rotational price action. The Nasdaq 100 continues to hang near its highs and the Russell 2000 has been showing substantially weaker performance. Until the indices get in synch in one direction or the other, I expect to see further consolidation in this range.

The S&P 500 is below resistance at 2092 – 2115 and above support at 2007 – 2034. As I’ve been stating, this is a zone where the index may consolidate for a time before its next larger degree directional move.

A move below 2007 – 2034 would shift the near-term odds in favor of the bears and target 1937 – 1963 while a break above 2092 – 2115 would be bullish and target new highs. On any move beyond one of these extremes, look for traders on the wrong side to scramble out of their positions and push the index in the direction of the break.

If you’d like to learn more about how to read the stock market using volume at price information, click here. http://www.volumeatprice.com