If you looked at your portfolio over the weekend, there’s probably no need to remind you that the market’s leadership is under pressure. This is especially true with respect to the Nasdaq, where four large cap stocks (the “FANG”) were bulletproof… until last week.

It’s always a significant moment in a bull market when profit taking finally hits the strongest stocks. The reason is that these are crowded, highly leveraged long trades for leading hedge funds and leverage cuts both ways.

Missing from that list, however, is the Biotech cohort, which also plays a very significant role in the 4-letter universe. Unlike Facebook, Amazon, Netflix and Google, which have only recently swooned, the Biotech sector has been under serious pressure since last July.

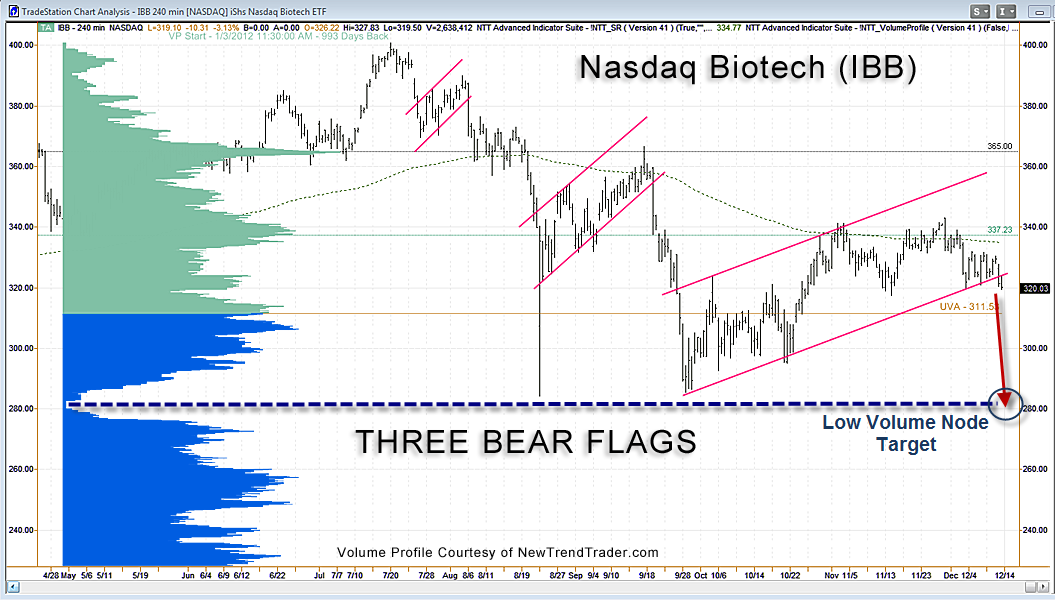

The accompanying chart shows a geometric pattern, the “bear flag,” commonly found in downtrends. Moreover, it appears that the third flag has now completed and if so, I expect a rather sharp decline is on the horizon.

The immediate downside target for the Biotech ETF (IBB) is the low volume area at $280. It is counterintuitive that low volume price zones can act as support, but believe me, it happens. The semi-good news for biotech lovers is that if the $280 level is taken out, the ETF has decent volume support at $272 and then $258, well before $225 comes into play.

I’m focused on the downside in IBB because I believe a gap-fill process is underway in the S&P 500, which completes at 1935-1948. If we get a mini-crash down to this level after the Fed announcement this week, there is a decent chance that the precipitous drop will lead to a curiously strong and unexpected pop.

If a sustainable rally were to arise out of that capitulatory implosion, it would require the participation not only from the FANG, but also from IBB. So, keep an eye on IBB if and when we get to that 1935 level in the S&P futures.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)