Hey, Traders from all over the world. How are you? I trust you are doing splendid. The holiday season is here and in full swing! I hope you have exciting, entertaining and enriching plans of merriment!

A trade that I am keeping an eye on is MOS. This trade has worked well the last two days for day trading. (I’ll be creating some day trading articles in the near future. Get ready for that!). Many traders played MOS bearish today and last Friday. Here’s what I see.

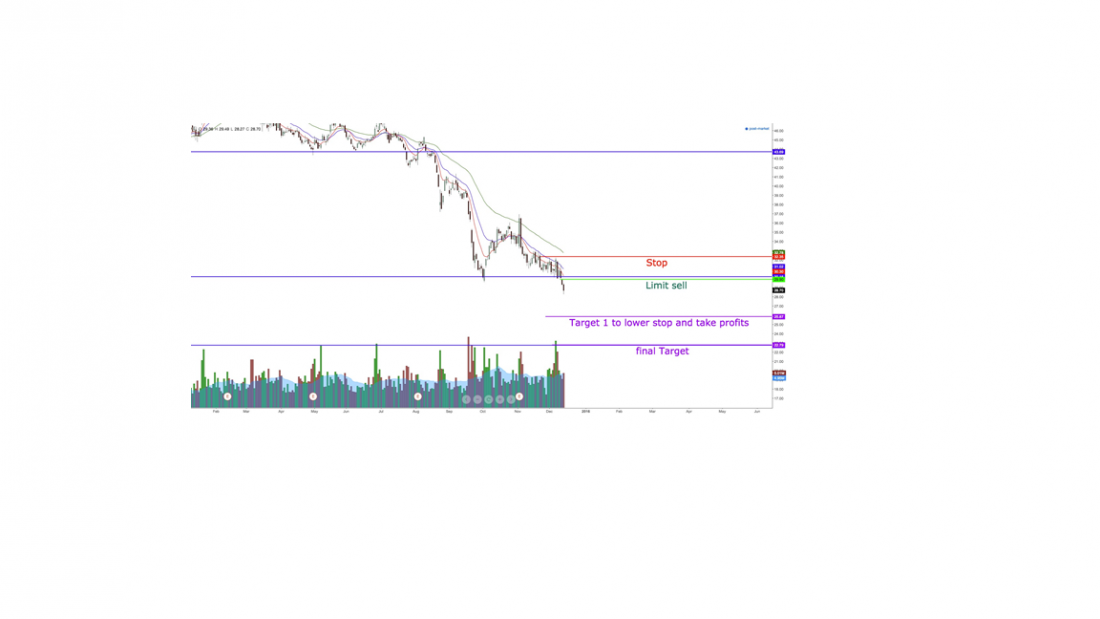

$30 is a strong support price on MOS. The trend is bearish with the stock being beneath the 10, 20, and 50 EMAs. Bullish volume increased nicely on 12/7/15 with a pretty solid buying candle. Then, the very next day, the low of that strong candle got taken out, trapping the eager buyers. Then MOS gapped down on 12/11/15. This was a black bearish candle gapping down. I call this a bearish retest gap. Therefore, I am anticipating MOS will possibly retest the strong support area. Setting up a limit sell price of $29.90, with a stop at $32.35. If one wanted to risk $500 on this trade, the formula would be the following. $32.35 – $29.90 = $2.45 $500 / $3.15 = 204 shares, or two possibly 3 options contracts.

Remember, $500 is not the investment amount, but the potential risk value. My first target is $25.87 to take half of the position off the table and lower the stop. Next and final resting place on MOS would likely be $22.79. That could become a nice play to buy low, sell high. Only one way to see what happens. Plan your trade and trade your plan! I’ll ‘see ya’ in a week.

Looking for the next profitable stock play? Visit RealLife Trading