Despite the general bearish tone of the market, or perhaps because of it, Monday was a good day. Once most traders are looking in the same direction (up or down) markets love to reverse.

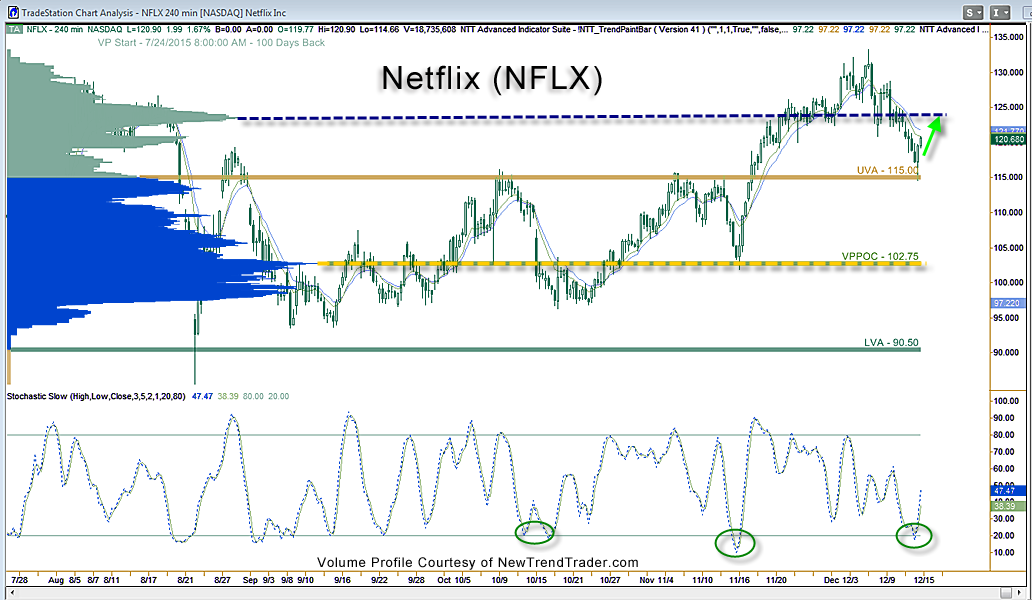

Many of the Nasdaq leaders posted nice reversal candles on Monday and Netflix was among them, up 1.67%. It wasn’t the strongest of the “FANG” stocks (Amazon took that prize, up 2.84% and Facebook added 2.48%), but Netflix bounced off a very important level. On the accompanying chart the “UVA” line that held for Netflix is the Upper Value Area. When price remains above this line on pullbacks it suggests that the uptrend is not over.

Moreover, Netflix only gets oversold about once a month (green circles) and this is one of those times.

While I like NFLX here as a trade up to the blue dotted line, at the very least, this moment of fair weather may be the eye of a storm that could resume on Wednesday afternoon after the Fed’s interest rate announcement. If the Fed raises rates it will mark the end of an easy money era that has been driving the 6-year bull market. No one knows what the reaction of ‘big money’ will be and that’s all that matters.

Things could go either way, but if a surprise rally were to develop after the Fed announcement I would expect money to flow aggressively into the FANG stocks (Facebook, Amazon, Netflix and Google). So keep an eye on Netflix on Wednesday afternoon.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)