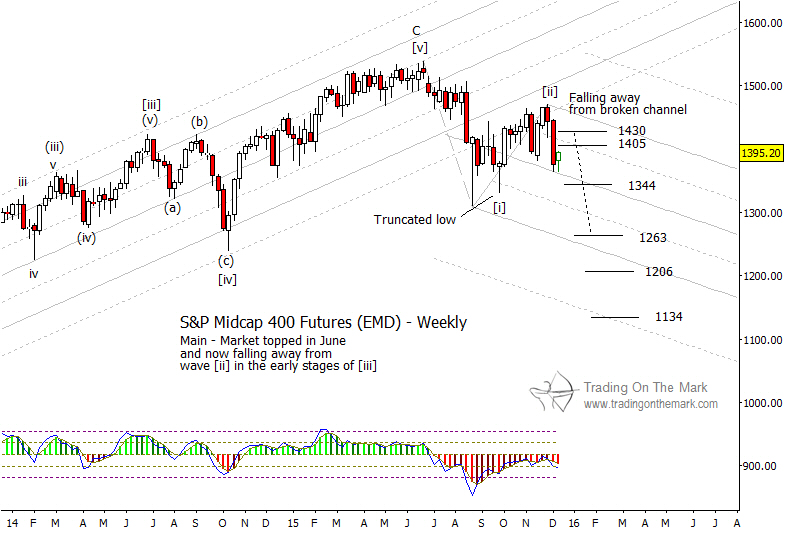

When we last wrote about the S&P Midcap 400 Index at the beginning of October, we recommended watching for a bounce and a retest of the broken channel on a weekly chart before looking for new shorting opportunities. In the weeks since that publication, the index has obliged, and we are provisionally using a downward impulsive count to project the next targets. However, the pattern in the midcap index is a little bit tricky. The weekly chart of its futures contracts shows how we believe the first and second waves of an impulse played out.

On the chart below, we have assigned the completion of downward wave [i] at the higher low that occurred early in October (about the same time we were writing the article referenced above). During that week, some major indices including the Russell 2000 and the German DAX made lower lows, completing an initial downward wave [i]. The London FTSE also had completed an impulsive wave [i] about a month earlier.

Using Elliott wave methods, first waves are sometimes sloppy. It can be helpful to look at several related indices to form a conclusion about what the larger market is actually doing. Both the Midcap 400 Index and the S&P 500 Index made higher lows at the end of September, but they count reasonably well as truncated waves (v) of [i] at a time when other indices were printing nicer-looking structures.

The bounce after the late-September low took the form of three waves in Midcap, consistent with an upward corrective wave [ii]. The correction also grazed along one of the lower harmonics of the broken channel that we had been following for so long on a weekly chart. The sharp decline as the index fell away from the channel during the last two weeks probably marks the beginning of downward wave [iii].

If the wave [iii] scenario is correct, then the decline should recognize Fibonacci the support levels we have marked at 1344, 1263, 1206 and 1134, with the most important initial target being a 1×1 measurement at 1263. A small internal bounce from near the present location might find resistance around 1405 or 1430.

Set yourself up for timely notifications of market developments by requesting our newsletter!