Interesting times, as the Chinese curse implies, tend to be dangerous. We are about to see just how dangerous they can be.

On Wednesday, after a year of yes-we-will-no-we-won’t, the Fed managed to raise interest rates a full 0.25%, and did it without crashing the market … yet. But despite all the cheering, this business isn’t finished; it is just beginning.

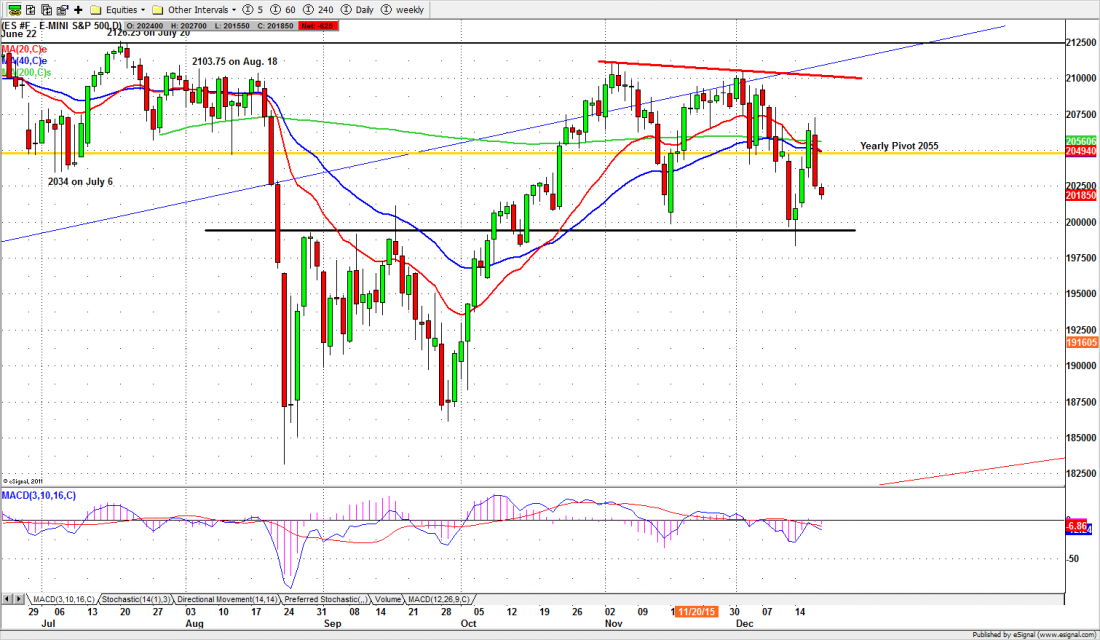

The S&P500, the large cap index, rallied strongly on Wednesday, after some wild intraday swings. But yesterday (Thursday) it gave back all of the gains, and closed at 2042, a couple of points below where it closed Tuesday. The price action was bearish, one big solid red candle.

A major issue, the very heavy and heavily unbalanced open interest in Puts, is unresolved. The opening price Friday will determine which Puts are paid out, and which are worthless. An opening price close to 2050 would save a lot of Put sellers from great pain; an open close to 2025 or lower would make Put buyers happy. The futures were down 10 points at one point in overnight trading, but that might change by morning. In any case, by now you should know something we don’t: who wins and who loses.

But that isn’t the end. The Fed rate increase may or may not crash the equities market, but it has already banged the bond market around, and it will shortly begin to affect the FX markets.

The bond markets, and especially junk bonds, took a hit from the Fed increase yesterday. So-called High Yield – a.k.a. junk bonds – dropped sharply in price, which means the yield went up dramatically. The yield on junk – ‘good’ junk – now averages around 9%.

Eventually that will have dire consequences for corporate borrowers when they have to rollover their bonds or borrow more. But it will have immediate consequences for the ETFs and funds that hold junk portfolios. According to Bank of America, about $5.3 billion was withdrawn from junk funds this week, on top of about $3 billion withdrawn last week. Two well-known funds have halted redemptions, which means their clients can’t get their money out.

This tends to develop into a downward spiral. High yield credit starts to go down in price, so investors want to get out. Funds have to sell bonds to meet the redemptions, so the price goes down further. When the price goes down further more investors want out, so more bonds have to be sold into a declining market. That’s how panic selling starts.

The effects on foreign exchange and the US dollar may take a little longer to be felt, but they are coming. The Fed has said it wants to see the Fed funds rate at 1.4% by the end of 2016. If it sticks to that plan, which seems unlikely, there will be a series of increases throughout the year, at a rate of about one every two or three months or so.

Whatever that does to the equity market (and it won’t be good) the effect in FX markets will be to make the US dollar stronger, if only because other currencies—the Swiss franc, the Euro, the Yen – have rates that are at zero or below. A strong US dollar sounds like a good idea, but it means commodity prices – denominated in US dollars – will fall, and the countries (and states) that depend on commodities will be poorer. They will buy fewer US goods and services because they will have less money.

All of this has made Wall Street rethink the euphoria that drove the stock market up when the rate increase was announced. With 20-20 hindsight, some commentators are now talking about the Fed’s “policy error” – not in raising rates, but in raising rates now, instead of a year ago. At the very least expect to see the Fed backtracking from the bold talk of Wednesday. And maybe changing their interest rate policy … again.

Today

The S&P500 mini-futures (ES) closed at 2024.75 Thursday, very close to the low of the day, after a sharp sell-off in the last 15 minutes. The futures are trading about 15 points below the cash index, which is an indication of where the market thinks the next move will be.

The futures (ESH6) could continue going down to fill the gap at 2009.50 or lower, and then bounce if the 2000 level holds up. On the upside, 2055-56 will once again be a major resistance zone

ES has bounced around the 200-day moving average line several times before. But each time it made lower highs. This is not a good pattern for the longer term. It indicates that the Top is in process. The market is now net negative for the year.

Major support levels: 2009.50-07.50, 1992.50-90.50, 1975.50-72.75

Major resistance levels: 2088-89.50, 2105-08, 2114.50-16.50

This is our last article for TraderPlanet until January. We wish all of our readers a happy and safe holiday and a prosperous and successful New Year. See you again January 3.

Get FREE Detailed market analysis from Naturus.com here: Naturus market analysis

Chart: ESH6 Daily chart Dec. 17, 2015