Now that the rate hike has been addressed there are crucial changes taking place within the S&P 500’s internal market structure. We’re seeing a major shift between the commercial and small speculator trading categories in positions as well as their degrees of certainty. We’ll dissect what this means in conjunction with the market’s declining open interest as prep for 2016.

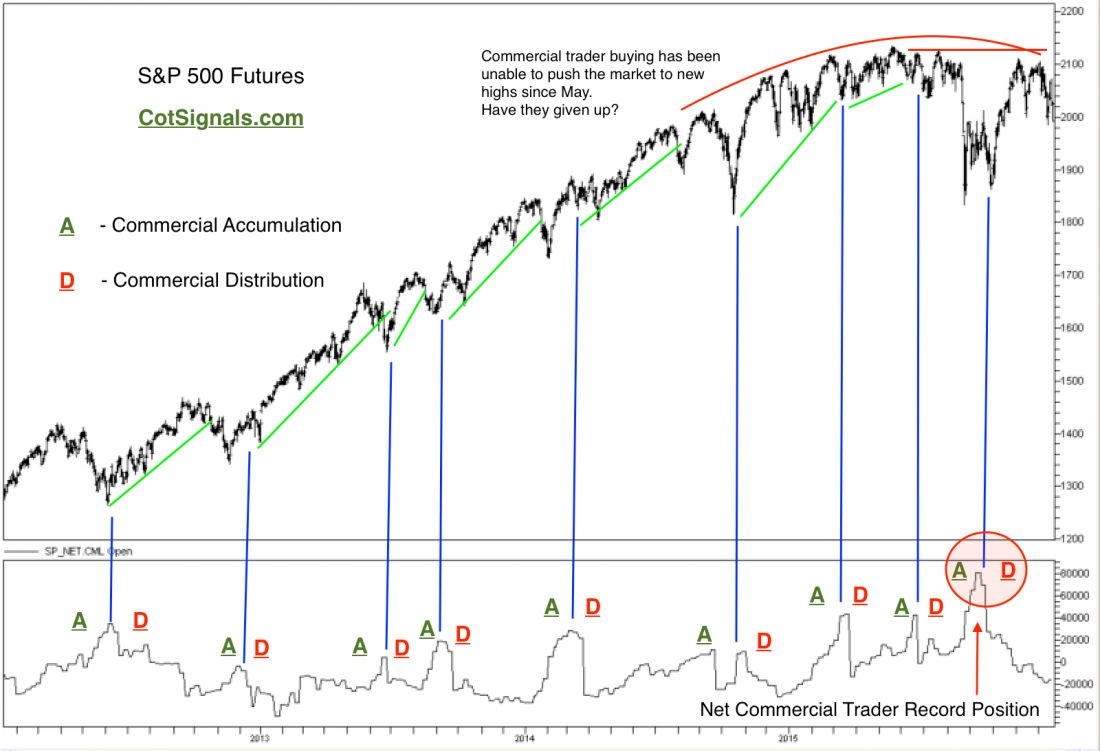

There’s a lot of information on today’s chart and before moving onto it in detail, I’d like to set the stage. Since the market bottomed in 2009 in the 500’s we’ve since rallied above 2100 as of this past May. The primary characteristic of the rally off the 2009 lows has been the dovishness of the Federal Reserve Board and the highly connected commercial stock index traders taking the Fed’s words to heart. The result of this has been commercial traders jumping in to buy market declines, in part, because of their confidence in the Federal Reserve Board’s ability to prop up the equity markets. The commercial traders’ pattern of accumulation and distribution is clearly laid out on the chart below.

Most importantly, each of the declines bought by the commercial traders quickly led to new highs and an opportunity for the commercial traders to offset their positions at a profit. This has been the case on every decline through this May. Commercial traders who bought the March decline off this past January’s meager rally were rewarded with a sideways market. Commercial traders then tried to push the market higher a second time during the expiration of the June contract. Their net long position fell short of March’s purchases and put us on the defensive through much summer publishing COT a sell signal on July 21st. Therefore, the market’s decline through August and September was not surprising.

What was surprising and is still the dominant feature in this market is that commercial purchases during this decline set a new record net long commercial trader position, eclipsing their previous net long record set in September of 2011. This pushed the S&P 500 back above 2000 with fresh fuel to test the May highs. The market has seen dramatic commercial selling since the accumulation of their record position and this leads us to believe that the commercial traders are turning bearish on the stock market as a whole. This fall’s failure to reach new highs on the heels of the Fed’s rate hike appears to be the very first sprouts of commercial trader consensus slipping to the bearish side in a new version of, “Don’t fight the Fed.”

This process rarely happens overnight and it is possible that a January rally of some sort may push the market higher. However, given the recent turn of events, we feel that equity rallies are to be sold until the market proves itself in the form of new highs or, a decline deep enough to put commercial traders back on the buy side.