The IPO market has been in hibernation mode with just one deal pricing (TEAM) in the month of December. The lack of activity is quite unusual for this time of year, when investment banks look to push as many deals through the door as possible before the books close on the year. Institutional investors have become much more risk-averse and have only been willing to sink capital into IPOs at prices they deem to be conservative. Consequently, many IPOs have been pricing below expectations, and/or have been cut in size, which in turn has motivated many companies to simply stay on the sidelines rather than to go public.

One company that isn’t letting the icy IPO market dash its plans to go public is Yirendai (YRD), a Beijing, China-based provider of peer-to-peer lending. In essence, the company is a mirror-image of U.S. based Lending Club (LC), which went public about one year ago on December 11, 2014. At the time of LC’s IPO, there was plenty of buzz surrounding its deal, primarily because the peer-to-peer lending concept was gaining popularity in the consumer finance marketplace as an alternative to more traditional means of securing capital. Indeed, LC’s growth rates were very impressive (revenue +123% for nine months ended September 30, 2014) and the runway for future growth was intriguing due to a massive addressable market. With optimism high, LC’s IPO priced above expectations ($15 vs. $12-$14) and opened with a bang at $24.75, good for a 65% pop.

But, the good times would not last as the stock went into freefall soon thereafter. In fact, by August 2015, shares were trading around the $10 level, sinking some 60% from its IPO opening price. A set of bearish analyst initiations following the quiet period expiration and initial quarterly results that did not live up to the lofty expectations (and pricey valuation) were the primary culprits to the stock’s demise. However, just like the turbulent IPO market didn’t phase YRD, neither did LC’s weak performance since its IPO.

YRD’s IPO Pricing

Earlier this morning (12/18/15), YRD’s 7.5 million ADS IPO priced at $10, which was in line with the proposed range of $9-$11. All things considered, the pricing can be viewed as a success given how tepid demand has been in the primary market for IPOs. In total, the IPO generated $75 million in gross proceeds, which the company says it will use for investments in product development, sales and marketing activities, capital expenditures, and technology infrastructure.

The investment banking firms behind the deal are solid, with Morgan Stanley, Credit Suisse, and China Renaissance leading the deal.

A Closer Look at YRD’s Business

Simply put, YRD is a Lending Club (LC) look-a-like that is headquartered in Beijing, China. Through its online platform, the company connects investors with individual borrowers. Its parent company, CreditEase, is a large financial services company in China that offers wealth management services, and will be an asset in YRD’s strategy to penetrate the mostly undeserved investor and individual borrower market there.

YRD’s borrowers and investors come from a variety of channels, such as online sources (internet and mobile applications), as well as through referrals from CreditEase. The company typically targets prime borrowers, including credit card holders with stable credit performance and income. In the future, however, the company says it may expand to serve new borrower groups outside of prime.

When a prospective investor visits the platform, they have the option to individually select specific loans, or to use YRD’s automated investing tool that identifies loans on the basis of a targeted return. YRD also provides a risk reserve fund service that helps limit losses to investors from borrower defaults. And lastly, YRD provides investors with access to a liquid secondary market, giving them the opportunity to exit their investments before the underlying loans become due.

For being such a young company — it was founded in March 2012 — the company has facilitated a large volume of loans. Specifically, since its inception through September 30, 2015, YRD has facilitated over $1.37 billion in loans. The company generates revenue primarily from transaction fees charged to borrowers for services provided through its platform in facilitating loan transactions, and it also charges investors service fees for using its automated investing tool or self-directed investing tool.

Key Growth Drivers

There are a couple key trends in China that are providing a strong tailwind for YRD’s business. For instance, consumption in China has grown significantly as a result of economic development and rising incomes. At the same time, consumer financing options have been limited in China. To put that into perspective, iResearch reports that China’s consumption loan balance to GDP was 24.2% in 2014, compared to 77.5% for the U.S. Consumption in China is under-financed mainly because loans from traditional financial institutions are not easily accessible.

Because of this imbalance between consumption and the need for consumer financing, there are opportunities for marketplaces that connect borrowers and investors. And the expected growth is very noteworthy. According to the aforementioned iResearch report, transaction values for marketplaces that focus on consumption loans are expected to grow from RMB12.7 billion in 2014 to RMB521.4 billion in 2019. That represents a staggering CAGR of 110.1%.

Financial Review

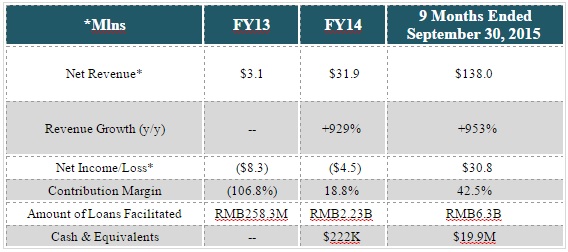

Taking a look at YRD’s recent financials, net revenues for the nine months ended September 30, 2015 soared to $138.0 million from $13.1 million in the year-ago period. Driving this growth was a surge in loans facilitated to RMB6.3 billion from RMB1.1 billion. The massive revenue growth enabled the company to swing from a net loss of ($10.9) million to a net income of $30.8 million for the first nine months this year.

Contribution margin is another key metric that YRD monitors. It is calculated by dividing contribution by total revenue, and factors that affect it are revenue mix, variable sales and marketing expenses, and origination and servicing expenses. Contribution is defined net income/loss, excluding general and administrative expense, interest income and income tax expense. For the nine months ended September 30, 2015, contribution margin improved vastly to 42.5% from (36.9%) a year ago.

Lastly, the company’s cash balance stood at $19.9 million as of September 30, 2015, but when including the net IPO proceeds, that balance shoots up to about $36.5 million.

Conclusion

Wrapping up, YRD’s growth is impressive without question, and its potential for future growth is compelling. The IPO has tier one underwriters behind it, and with a dearth of other IPOs, YRD will have IPO investors full attention. However, it still faces a daunting uphill battle given the sour conditions in the IPO market. And, it doesn’t help that it is a Chinese IPO, which carry even more risk.

The good news for individual investors, though, is that YRD’s mediocre pricing and weak open (shares trading at about $8.50 as of this writing) could create a compelling opportunity for those who are willing to take a patient approach and are comfortable taking on a little more risk. The combination of YRD’s strong growth, its shift to profitability, and the discounted stock price makes the risk-reward look appealing.