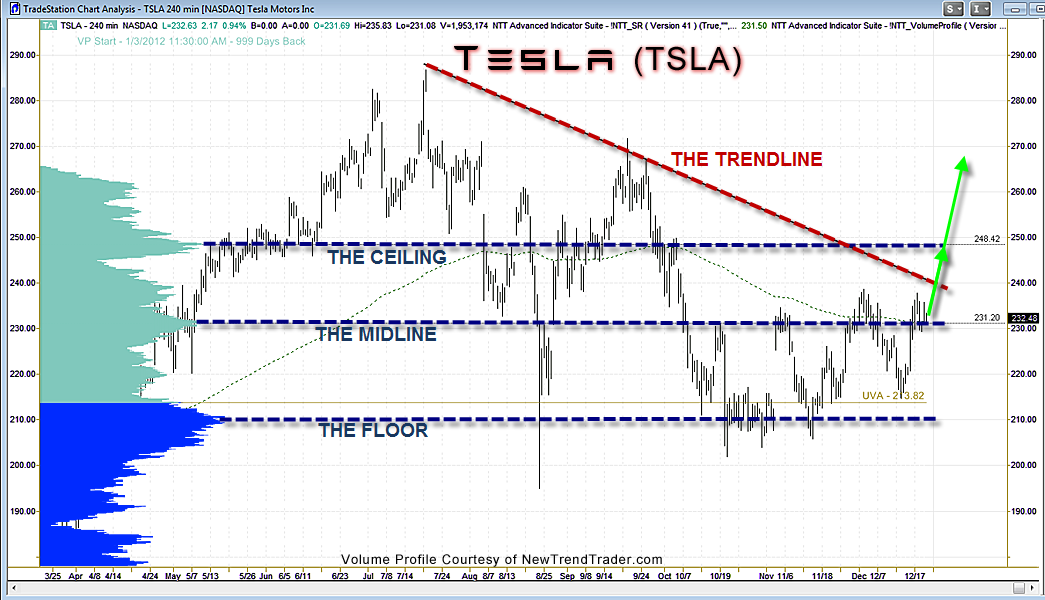

Over the last three months shares of Tesla (TSLA) have been consolidating in a range between three high volume nodes: $210 is the Floor, $231 is the Midline and $248 is the Ceiling (see accompanying chart). In the bigger picture, the consolidation has been going on since early July.

During this period the company successfully introduced the Model X and continues its global expansion. Tesla added 107 Supercharger locations in the U.S. in the last year, more than doubling its 2014 total. More importantly, it added 851 ‘destination’ chargers in the U.S., bring the total to 1122. Destination chargers operate at a slower rate, but are a draw for local businesses. Plus, its partner Solar City (SCTY) is probably not going bankrupt.

Notably, while the general market has been selling off, TSLA is stabilizing around it’s midline. In other words, this is a stock that cares nothing about the index in which it resides. The correlation between TSLA and the QQQ over the last six months is minus 0.19, which means there really is no relationship. During this market correction, TSLA is demonstrating impressive relative strength.

About 28% of Tesla’s float is sold short, which is the basis for my prediction that the stock will soon attempt a breakout. The first target is $248 and if that level can hold, TSLA should move significantly higher. In my view this is an attractive spot to get involved. I don’t expect shares to drop to the $210 level ever again.

www.daytradingpsychology.com (Coaching for private traders.)

www.trader-analytics.com (Peak performance consulting to RIAs, hedge funds and banks.)