Given the secular slide in crude oil, it’s no surprise that the energy sector has been the worst performing SPDR sector in 2015. The SPDR Energy ETF (XLE) is down 12% this year, more than double the decline of the other primary lagging sector, Basic Materials (XLB).

Meanwhile, Consumer Discretionary (XLY) has been the clear leader in the ETF Sector race this year, posting a 12% gain due to strength in housing and the dividend from lower prices at the pump.

This weekend, however, I noticed that the Energy SPDR (XLE) recently made a new multi-year low, but then failed to follow through to the downside. With crude oil having fallen to 2009 levels, XLE is merely testing 2012 lows. That’s hidden strength.

I pay attention when the market fails to do something expected. It often signals a potential reversal in the making, especially when there is a large group of passengers on one side the ship. Crowded trades often unwind in a spectacular manner.

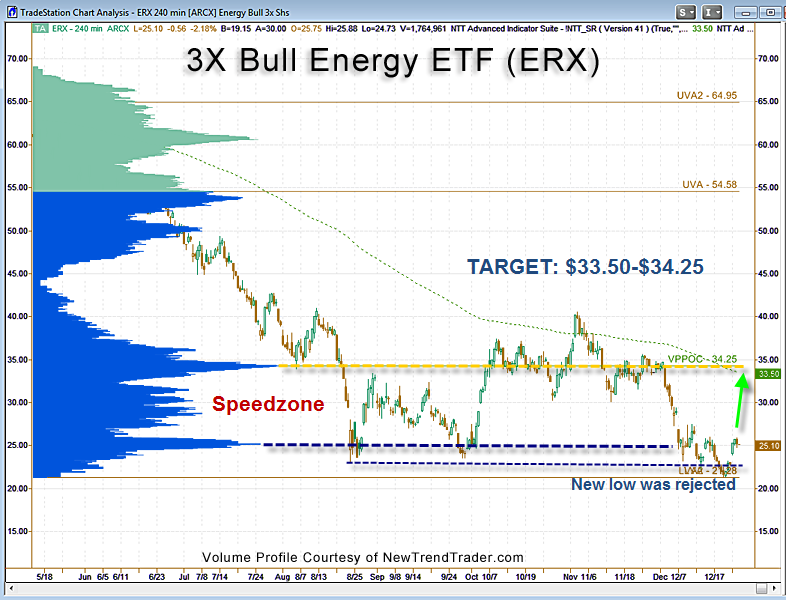

I’m a trend-follower by nature, but there are times when it makes sense to consider a counter-trend trade and I use Volume Profile (volume at price) to help with those decisions. So I reviewed both (XLE) and its triple leveraged counterpart (ERX) for volume support and resistance levels and noticed something interesting.

Last week ERX rose above a High Volume Node (thin blue dotted line on the chart) and has a speedzone up to the Volume Profile Point of Control at $34.25. A speedzone is a price zone through which price has previously moved very quickly. XLE does not have a volume configuration quite as bullish.

XLE and ERX are 99% correlated. In my view, a move above $26 in ERX would open the door to $34.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)