Hello day trading enthusiasts! I hope this article finds you excited and eager about 2016! If it’s anything like 2015, I am expecting a lot of volatility (which is great for day trading).

I wrote an article in the not too distant past regarding 5 steps of day trading. Feel free to find it here.

In this article, I want to focus on a specific type of gap. I call the bullish gap and go.

What this gap needs:

- A black candle (on the prior day)

- The stock to be gapping up (on the day you’ve found the gap)

- The gap clearing a resistance/pivot.

I agree the 3rd pivot is the most subjective part of this and does take a little practice. I try and sum this up by asking the question “if I got into this stock recently, would this gap be hitting my stop, forcing myself or others to exit or want to exit a bearish trade, or become emotional?” If the answer is yes, this is likely a good gap.

A more quantitative way to describe this: If the gap is more than 3% but less than 18% and is opening above a price which the stock hasn’t traded past in more than 2 months.

Again, the “2 month rule” can easily change if the gap is flawless, but it does take practice finding incredible gaps. Therefore, if you start with very rigid rules and then you begin to understand what makes an amazing gap, you can become a little more fluid with the numbers and expectations.

Once you have found the gap, there are various ways to play it. Depending on your experience level you could either

Take the break of the high on the 5 min candle.

Take the break of the high on the 3 min candle.

Take the break of the high on the 2 min candle.

Take the break of the high on the 1 min candle.

I would encourage you starting with the bigger time frame if you are newer to this bullish day trading strategy.

What makes this play stronger is:

A black candle on one of the above time frames.

A candle with an upper wick on one of the above time frames.

A small candle on one of the above time frames (I define small by ‘the high/low range is less than 1% of the stock’s value.)

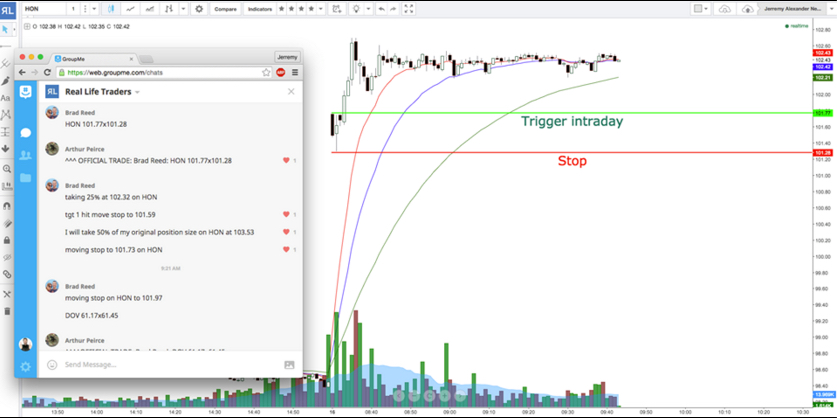

From there, set up the trade. Determine how many shares you will short per your risk. Pull the trigger. Below is an example of this set up on HON recently.