Uncertain markets make us take unusual approaches.

The markets are skittish to say the least. It’s very hard to “pick a lane.” What to do? You are nuts if you think you are going to pick lows and/or sell highs. You have to be balanced. That way you don’t find yourself “handcuffed”. I talked last week about having a “wish list”. This is where we find ourselves looking for names that have been hard to buy for any value. In these markets you can certainly find things “on sale”. But to just load up long is quite foolish if you are not a long term investor as opposed to a trader like we are. That means for every bargain you find, you have to offset with a short position. That way, you can trade on down days and rallies. Our entry in FIVE is an example of this.

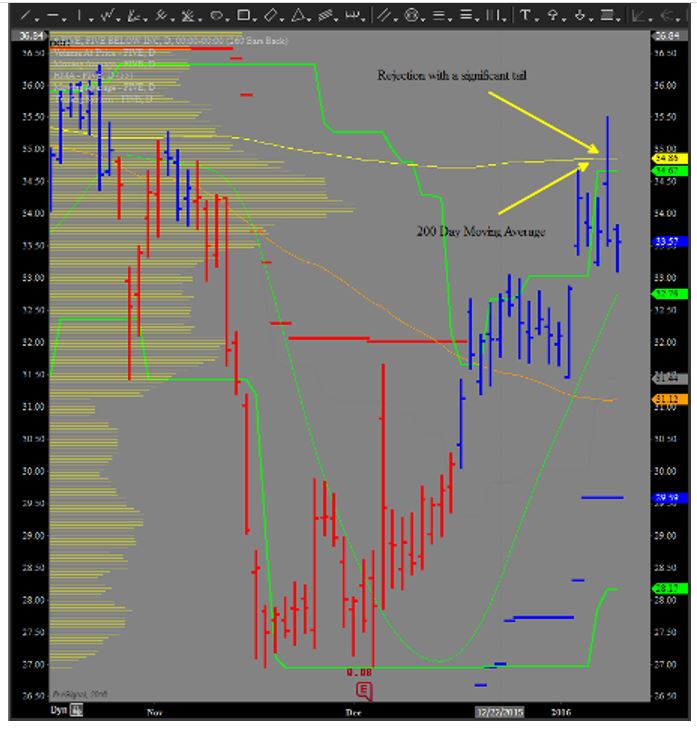

You will notice the rejection off of the 200 day moving average indicating a reversal. Our signal is as follows:

1-11-16: Based on our methodology a signal has been generated:

Buy (opening) the FIVE February 31 put

Sell (opening) the FIVE February 29 put

For a DEBIT of $0.50 or less.

This signal is not GTC and is valid with FIVE trading $33.75 or lower. 3:1 odds buying ourselves over a month of time.