Why isn’t anyone blaming the Federal Reserve for what is starting to look like a rout in US equities?

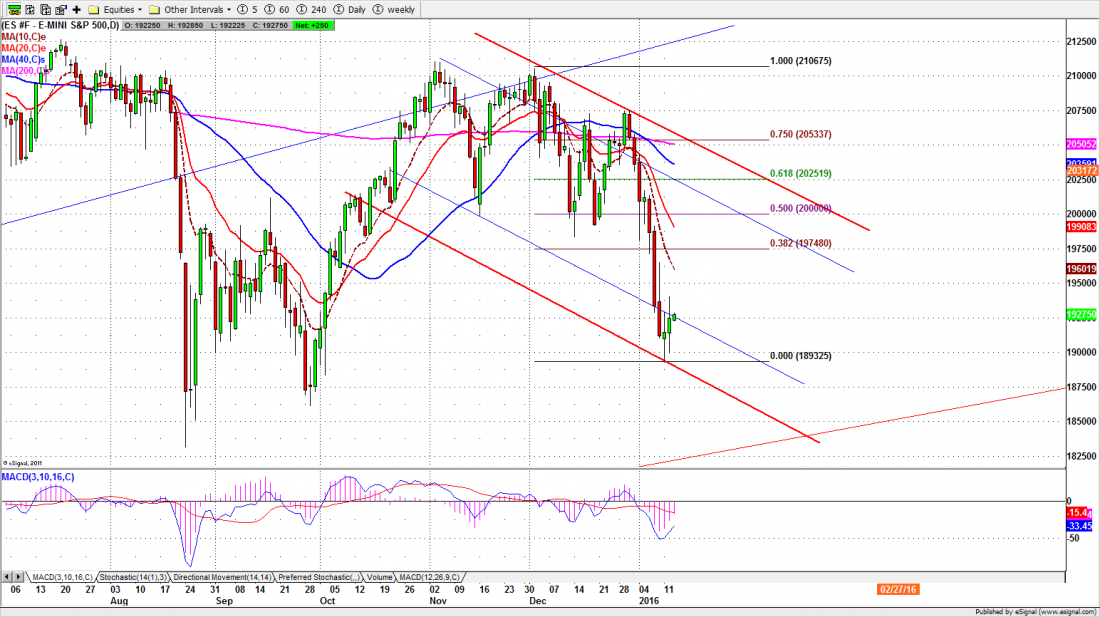

Last week US stocks had the worst opening week for any year in the history of the New York Stock Exchange. The large cap index (SPX) fell about 6% — 160 points in seven trading days — and tested support levels that go back to October.

It has since made a dead cat bounce and recovered a little, but nobody thinks the Bull is back. And this is supposed to be the best time of the year for equities, when the January effect floats all boats. If these are the good times, please, somebody save us from the bad.

Did the Fed do this to us? Is this the result of the Fed interest rate hike in December? I mean it seems to fit: less than a month ago the Fed raised rates for the first time in six years; and three weeks later equities have their worst week ever for this time period. Post hoc ergo propter hoc?

Nobody is blaming the Fed, at least in public. One of the surprising things about this scary New Year’s hangover is how little anybody talks about the Fed at all. They have disappeared from the public dialogue.

Before the December rate increase, every bad thing that happened – commodities crashing, turmoil in China, war in the Middle East – was discussed solely in terms of what the impact might be on the Fed.

The news is bad! Good. That means the Fed won’t raise rates.

Now the Fed is surprisingly irrelevant. They’ve done the deed, and now bad news is just … bad.

And there’s lot of it, so much so that we are now officially saying that a Bear market has begun. “Buy the dip” has morphed into “sell the rallies.” The sentiment has changed, and despite all the perplexing arcana involved in market analysis, sentiment is what pulls the train.

We think you can date the beginning of the Bear market to last Friday afternoon at 3:30, when both the Plunge Protection Team and the usual end-of-day price ramp failed to materialize. The Bulls surrendered and the market dropped another 20 points.

Since then we’ve had an oversold rally or two, and there could be a final spike top to give the longs now trapped under water a chance to escape.

But don’t let it go to your head. This isn’t the end for this decline, or the beginning of the end. It isn’t even the end of the beginning.

Capitulation. It’s a word you’re going to hear a lot this year.

Today

All this bouncing around in the markets may make investors moan (and not in a good way) but for short-term traders – that’ us – it is heaven. The big intraday price swings make it relatively easy to capture outsized profits.

For example, we made some extraordinary gains on Monday, thanks to a little nifty footwork at the market turns. There’s a brief commentary about it on our website at http://www.naturus.com/trading-summary-for-jan-11-2016/ if you want to see how it works.

Yesterday the S&P500 mini-futures (ES) closed at 1925.25 after a 10-point rally late in the day. The contract managed to hold above the prior day’s low and made a higher high, which looks very positive.

Don’t get sucked in. There may be another little rally early today (Wednesday) but there is minor resistance around 1945-47 and a major resistance zone around 1955-65. We don’t expect the market to get through that.

The pattern we’ve seen is the price moving up overnight, when the volume is thin, thin, thin, and then dropping back during the day, when the managers trapped in long positions come out and sell into the rallies. We kind of suspect they’re the people who start the overnight rallies in the first place. Pump and dump.

The major support levels: 1888-86.50, 1866-62.50, 1856-50.25;

Major resistance levels: 1956.50-57.50, 1970-65.50, 2005-98.50, 2014.50-17

Once a year Naturus has a half-price sale: 50% off every service we offer… but only until January 24. You can see the details at www.naturus.com

Chart: ESH6 Daily chart, Jan. 12, 2016-01-11