In recent months, U.S. and European equity indices have begun falling away from their long-term upward channels. In other posts at TraderPlanet, we have noted bearish patterns developing in the S&P 100 midcap index and the London FTSE index, and elsewhere we have described similar developments with the Russell 2000 and the S&P 500 indices.

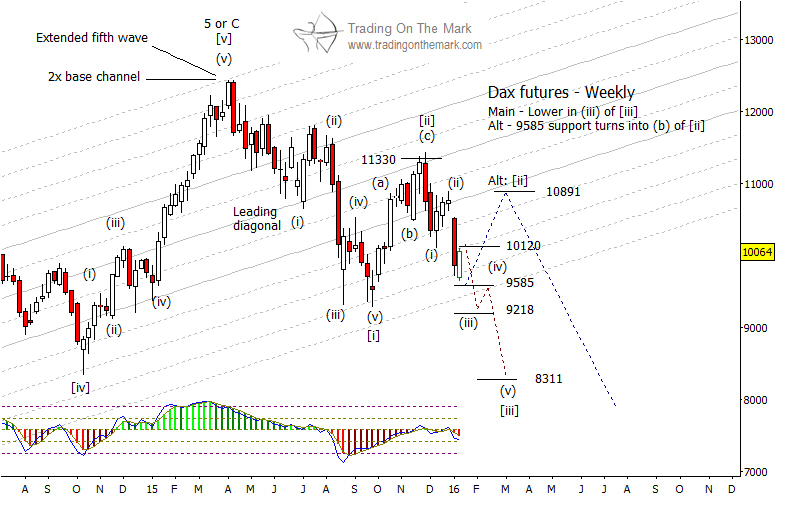

With all of the indices apparently in the midst of a developing downward pattern, potentially bearish traders will be looking for areas and price levels that can serve to confirm that price can move farther. Our weekly chart for the German DAX, below, shows some of the levels we’re watching.

Although the chart includes fairly detailed labeling of the Elliott wave structures, the most important structure calling for the trader’s attention is the potential [i]-[ii]-[iii]… that began with the early 2015 high.

In order to remain confident staying in an already existing bearish trade, we would want to be relatively sure that the corrective wave [ii] was finished, and not merely “halfway finished.” The alternate scenario on the chart (drawn with the blue dotted line) shows how price could find support nearby and embark on another upward leg of wave [ii] before falling in wave [iii].

We do not believe the alternate scenario is what’s happening, but it is important to have a backup plan. If the alternate scenario begins taking hold, then the resistance area near 10,891 could represent another opportunity to look for short positions ahead of a downward wave [iii].

On the other hand, if our main scenario continues to play out (shown with the red dotted line), then bears can be more confident remaining in a trade if price manages to get solidly beneath the 9,585 area (and even better, the 9,218 area). Those developments would make it more likely that the index can continue moving downward to test near the wave [iii] target near 8,311. Eventually, the index should go considerably lower than that.

Our next newsletter will focus on crude oil futures and the Dollar. Request your copy!