While selling options on commodities contracts may sound like an exotic and/or glamorous investment strategy, in reality it’s more show up for work and follow a formula. Call it “lunchbox” trading.

The Formula is called FUDOM* and its steps are simple:

- Find a Market with Clear Fundamentals – Bullish or Bearish

- Sell Deep out of the Money options against those fundamentals

- Force the Market to Make a huge move against those fundamentals during a certain time period – if it can’t do it, you take the premium home.

(*To learn more about the FUDOM method of selling options, see www.OptionSellers.com/FUDOM )

If it was a football play, it would be the fullback up the middle for 5 yards. Over and over and over again. You don’t have to find the perfect opportunity. You don’t have to scan and search and filter for “overvalued” or “undervalued” markets. You don’t have to figure out something “nobody else knows.” Simply take the information already available and apply a high odds approach to it. With those criteria in mind, allow me to present the Wheat market.

The Bear in Wheat

Wheat is a commodity whose fundamentals appear decidedly bearish. These fundamentals will likely be a burden on price for much of 2016, making wheat a prime candidate for call sellers. What are these fundamentals? The 3 with the biggest impact on price are covered below.

Top 3 Factors Affecting Wheat Price in 2016

1. Global Ending Stocks are Highest in History: Due to bumper crops across much of the wheat producing world (thank rapidly improving genetically modified crops), global ending stocks are expected to balloon to 229.86 million metric tons in 2016 – the highest in recorded history. 2015/16 will show the highest World Wheat Ending Stocks in History

2. US Wheat Stocks to Usage at Second Highest Level on Record: The Runaway US dollar has made US wheat less competitive on the world market. A strong dollar makes US wheat expensive to global importers. Why buy US wheat when you can buy French or Russian wheat at a 10% discount? This has resulted in US inventories accumulating. The US wheat stocks vs expected domestic usage ratio has surged to 45.1% – the second highest on record. 2016 is expected to show the 2nd highest Stocks to Usage on record for US wheat

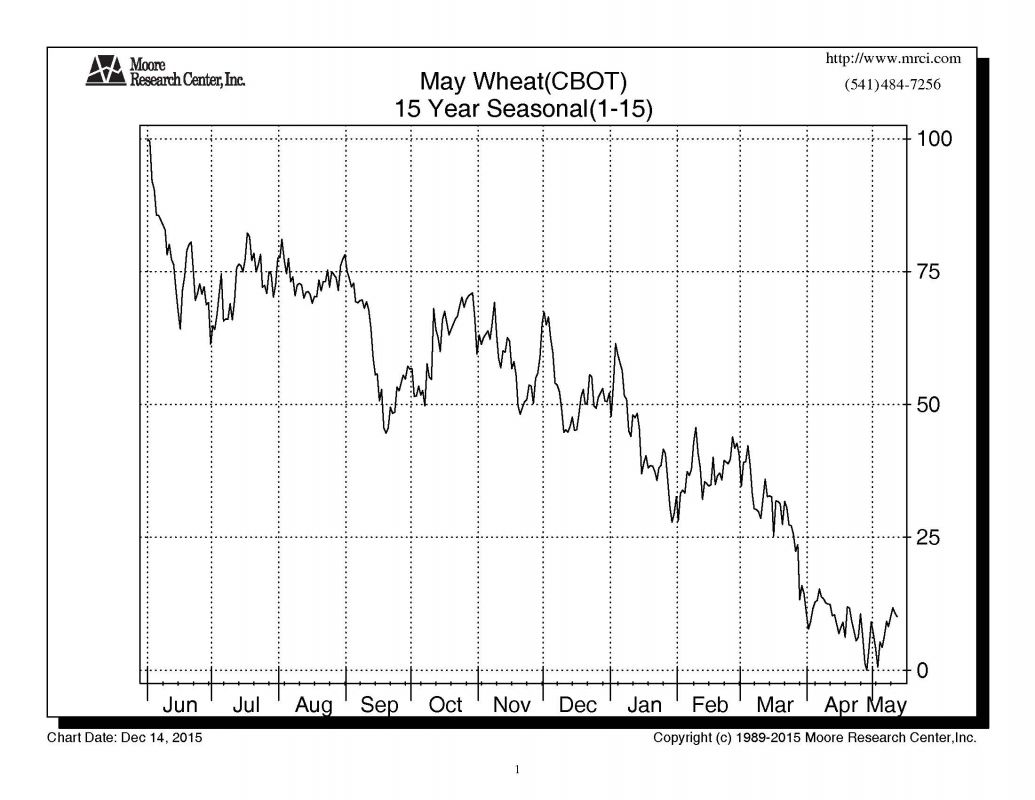

3. Seasonal Fundamentals are Weak:

Unlike it’s cousins, corn and soybeans, wheat prices seldom benefit from the planting season price anxiety often seen in the US Springtime. Why? Because almost ¾ of the US wheat crop is winter wheat which is planted in the fall. Therefore, when traders and farmers are wringing their hands in March and April about weather conditions and how fast or slow their corn and soybean crops are getting planted – 75% of the wheat crop is already in the ground. Thus, the market tends to take its price cues from the newly harvested supplies leaving the shores of such exporters as Australia and South America. Historically, this has kept pressure on wheat prices during the US Spring.

Conclusion and Strategy

The combination of massive US and Global wheat supplies combined with a strong US dollar (not helped by last month’s Fed rate hike) has kept wheat prices under pressure in the second half of 2015. The problem for wheat is, these fundamentals are unlikely to change anytime soon. It takes awhile to work through that much of a supply backlog. Further confounding the wheat bulls is the upcoming seasonal tendency for weaker wheat prices in the Spring.

Selling the July 6.20 Calls in Wheat

Does this mean that wheat prices can’t rally? Of course not. Markets can rally for a variety of reasons – often in the face of contradictory fundamentals. What it does mean is that a substantial, sustained rally is unlikely. The burdensome supply outlook will likely mean heavy commercial selling coming in to stifle any technical rallies. That means a market ripe for call sellers. We’ll be watching the wheat market for appropriate times and strike levels to sell calls for our managed accounts this month. Self directed investors can look to sell the July Wheat 6.00 calls on rallies. More aggressive traders can consider the May Wheat 5.80 calls. Look to take premium of at least $500 per option.

Are you fearful of bad year for stocks in 2016? OptionSellers.com offers a maintenance free, managed commodities option selling portfolio for high net worth investors. If you’re interested in gaining real diversification from stocks and the ability to target high returns, we can help. For more information, request a complimentary Investor Discovery Kit today at www.OptionSellers.com/Discovery