OMG! Just when you thought the market was finally starting t make sense – unpleasant for some, but rational for a change – along comes the Federal Reserve to try a little word magic again.

Yesterday the President of the St. Louis Fed, James Bullard, gave an interview pointing out that low oil prices are making it difficult for the central bankers to get inflation up to the 2% ‘target’ rate. And then he added a mundane comment that “oil has to hit a bottom somewhere.”

The Machine jumped on this as evidence that the Fed’s trading desk will now start buying oil, the price will start going up, the Fed really does have our back, buy! Buy some more! More! Get in there Mortimer, and start those machines!

By the time this foolery was finished the S&P500 mini futures (ESH6) closed up 33 points … just in time to get the settlement price for the SPX options, which settle at the open today, back above 1920, thereby saving a few Put sellers from great pain.

The large cap index is down about 9% in the past two weeks, and today’s rally won’t change its general direction. In fact the futures, which closed at 1914.50 after the Bullard bounce, traded back below 1900 overnight.

Bullard, you might remember, was the one who halted a similar sharp decline and started a rally that took the market to new highs in the fall of 2014 when he casually speculated that the Fed might do a little new quantitative easing.

So it’s not surprising to see a successful ploy tried again. What’s interesting is the relatively modest result. The Fed may really be out of ammunition this time.

That’s not to say we won’t get a bigger rally out of this. Bull markets often end in a spike-top buying frenzy.

But encouraging words from the Fed don’t seem to have the same impact they used to have. After all, we’ve heard them all before. Too often.

Today

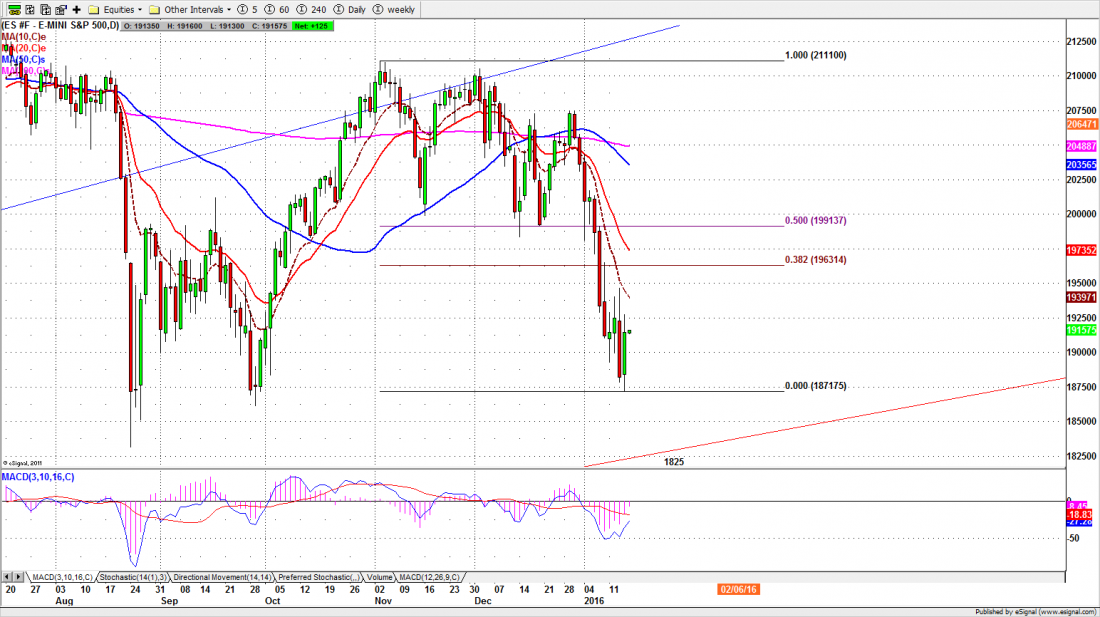

The ES made a low at 1871 yesterday (Thursday) before Mr. Bullard came to the rescue. That’s 10 points above the low made last October, and 40 points above the low made in the August crash. Those are important levels.

But this market has been dropping 40 points a day without any effort, and so far we don’t find this one-day rally very convincing. It looks to us like profit taking after a short-term oversold condition developed. We may have another up day or two, but don’t start thinking that the Bull is back. It ain’t.

Today the ES options expire at the end of the day. We will be watching the 1929.50 level; it controls any potential upside movement. A move above it could continue to squeeze the shorts and push ESH6 price up to 1939-43 or higher up to 1955-57.50 if the upside momentum is strong.

But holding below 1929.50 could lead the ES down to test yesterday afternoon’s breakout level 1902.75-06.25. A break below 1895.50 will be bearish again; a further decline should then be expected.

And overnight the futures traded down to 1894.75. It will be close.

Major support levels: 1866-62.50, 1856-50.25, 1830-25, 1800-1795

Major resistance levels: 1929.50-32.50, 1956.50-57.50, 1970-65.50

If you want to Nat’s free weekly market preview, click here.

Chart: ESH6 on Jan. 14, 2016. Daily bars.