A week ago I noted that Apple’s recent lack of relative strength is a bearish ‘tell’ on the market. The reason is that the stock is not over-valued and sports a decent dividend. Nevertheless, shares are down 25% from the May 2015 high and recently broke the $100 mark. This is a market in which ‘quality’ does not matter.

Presumably, Apple stock was being sold to buy the FANG gang during the autumn rally, but that trade is over. Now, Apple is being sold because in bearish times investors sell winners to book profits, while often holding losers. It’s a psychological quirk of human nature; a type of semi-neurotic internal bookkeeping that makes us feel like winners in tough times.

If you trade intraday you may have noticed that shares of Apple are being bought and sold as a proxy for the general market. Right now all rallies should be sold, but the good news is that Apple is clearly so important to this market that we have in the technical pattern of the stock a near perfect timing mechanism that will tell us when we can expect a truly tradable rally in the broader market.

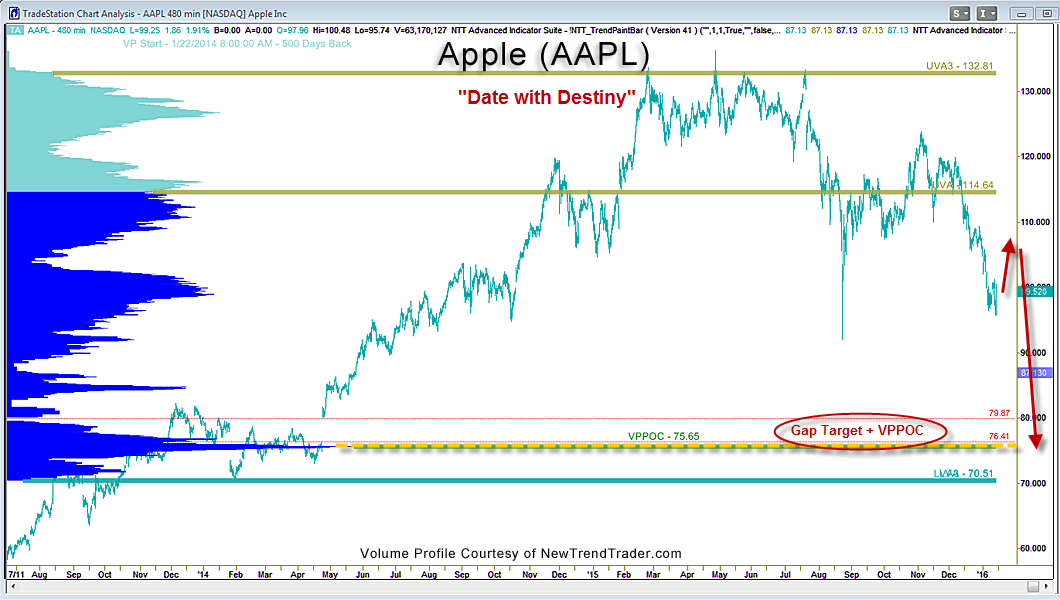

That pattern is indicated on the accompanying chart. It shows a rare confluence of two key indicators, the Volume Profile Point of Control and a significant gap in Apple shares. This convergence around $75 has enormous magnetism, but it’s not friendly like gravity, it’s more like a black hole. I see no way the market or AAPL can resist the pull of this dark star.

I called for a rally this past Monday and we have had a faltering attempt at price stabilization this week. The market is at substantial short-term technical support and should be able to put in a better showing next week. I’m looking for a relief rally to 196 in the SPY.

If I’m right about the bigger picture, however, AAPL has a date with destiny 25% lower. Factor that into your trading plan for the spring of 2016.

www.daytradingpsychology.com (Peak performance coaching for private traders.)

www.trader-analytics.com (Services for RIAs, banks and hedge funds.)