Netflix represents the “N” in the “FANG” gang, a group of former market leaders that has been leading to the downside in the New Year.

Of the ‘Gang of Four,’ only Netflix has a significant level of short interest: 13.5%, which is very high for a market darling. In comparison, only 1.5% of Amazon’s float is short. This means that in a FANG Gang rally, which I expect to happen this week, NFLX is likely to outperform. At least on Tuesday.

Netflix reports earnings 1/19 after the closing bell. This circumstance raises the stakes for the short sellers, who are likely to cover aggressively if the market enjoys a post-holiday party. This party was postponed last week due to options expiration, but should arrive with a bang.

Netflix is expected to report a 2 cent profit for the quarter vs a 1 cent profit a year ago. In other words, this event isn’t about earnings; it’s all about subscriber growth. The whisper number is 75 million, which would represent a ‘beat’ of 1 million based on the company’s year-end forecast given last October. That figure is 400,000 larger than the Wall Street consensus estimate.

A significant ‘beat’ is required. Netflix is the target of a great deal of skepticism concerning its ability to grow subscribers, as a variety of heavyweight streaming competitors are targeting the NFLX market share. Having been the best performing stock in the S&P 500 in 2015, management needs to impress.

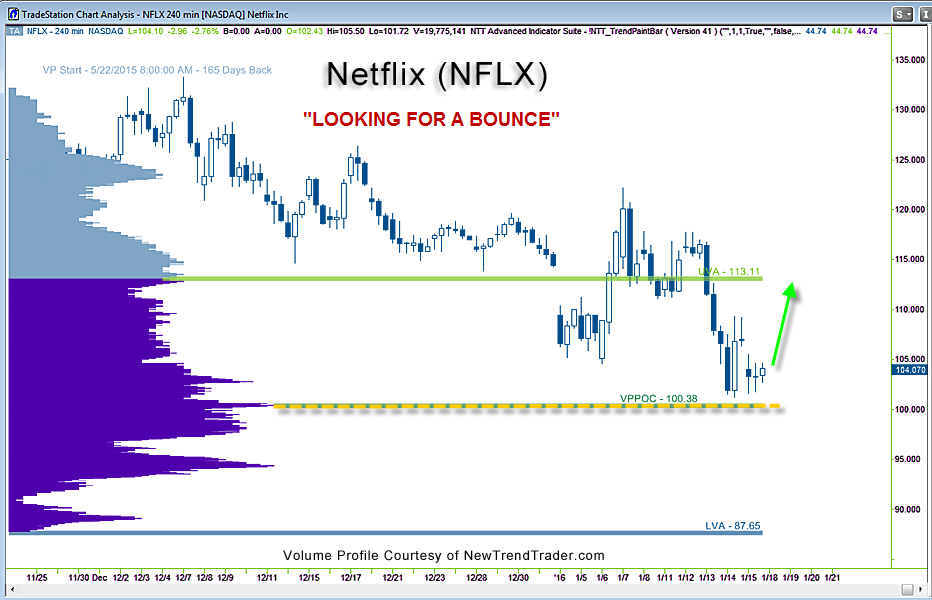

The good news for the NFLX bulls is that the stock has been basing near its Volume Profile Point of Control around $100. This is a key level of support that should serve as a floor for the expected rally.

The upside target is the Upper Value Area boundary at $113. That would be an impressive move, especially if it happens in one day.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for RIAs, banks and hedge funds)