The hits just keep on coming for the IPO market. One week after Shimmick Construction postponed its IPO, Elevate Credit followed suit and pulled its IPO on January 21, which means 2016 has not yet seen an IPO successfully price. Given the turbulent market conditions, it is understandable that companies looking to go public would be in no rush to do so. Investors have been fleeing their riskiest assets — including recent IPOs — so demand for new deals has completely dried up.

One of the next companies to test the waters will be AmeriQuest (AMQ), a developer of cloud-based B2B software that helps enterprises better manage complex operational and administrative processes that are commonly managed manually.

The company is selling 6.2 million shares, all of which are being offered by the company, with the shares currently expected to price within a range of $11-$13. If (and that’s a big if) those terms don’t change, the deal would raise roughly $64 million in net proceeds for the company. The company says it may use some of the proceeds for future acquisitions, and/or it could use a portion of the proceeds to pay down its outstanding debt. Either way, it is a positive that the company, and not selling shareholders or a private equity firm, is offering the shares, as the company can use the capital to fuel growth or enhance profitability.

Closer Look at AMQ

AMQ is a cloud software developer that targets enterprises with a mission of helping its customers drive improved operational efficiency by “applying the latest technologies to the oldest B2B workflows and kicking out the paper in the process.” It uses proprietary technology, as well as deep customer and supplier relationships, to enable its customers to reduce the time and resources used on operational and administrative processes.

The company originally focused on the transportation industry, through its procurement and fleet management solutions businesses, but it has since branched out and expanded its offerings in order to serve multiple industries. Overall, the company serviced more than 2,250 customers during 2014, notably including Daimler Trucks North America, the University of Florida, Dot Transportation, and Cardinal Logistics Management.

AMQ’s software offerings can be segmented into three separate areas: Financial Process Automation, Procurement, and Asset Management. Here is a close look at each offering.

- Financial Process Automation: This software enables companies to streamline, automate, and manage transaction processes such as e-invoicing, accounts payable, accounts receivable, collections, order management, and credit risk management. One of the key benefits of this offering is that it allows companies to eliminate unnecessary overhead, as well as reduces errors related to doing these tasks manually.

- Procurement: AMQ’s procurement solutions enable organizations to realize the benefits of volume-based, electronic procurement by identifying and establishing contacts with suppliers, aggregating the collective purchasing power of all participating customers, and creating process efficiencies of electronic transactions. More specifically, AMQ’s purchasers gain access to more than 5,000 dealers and distributors for over 135 suppliers currently using its software.

- Asset Management: This solution is primarily presented to the transportation industry today, but, the company believes they have applications across several other industries. Specifically, its Asset Management solution provides data-driven strategic planning, asset acquisition and disposition strategies, and asset financing and utilization alternatives. All of these solutions are designed to lower the total cost of asset ownership.

Financial Review & Valuation

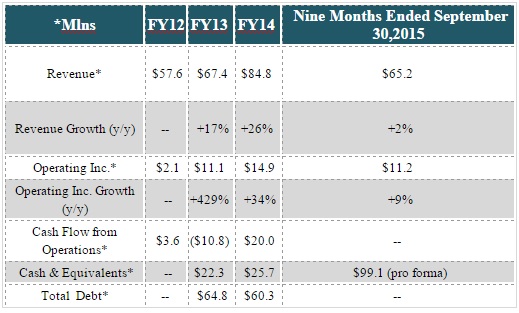

AMQ’s financials are a mixed bag overall. On the positive side, the company has an established track record of profitability, and positive cash flow generation, which is somewhat rare for a technology IPO. Also unlike many younger tech companies, AMQ has a good handle on its expenses — in particular, its Sales & Marketing expense. For the nine months ended September 30, 2015, Sales & Marketing expense was up a reasonable 9%, and total operating expenses were up just 5%. Those are significant positive attributes. But, there are some concerns here as well.

First, as we have already mentioned, revenue growth decelerated sharply in 2015. Not surprisingly, the slowdown was mainly driven by lower revenue in its asset management segment (down 4% y/y), which has high exposure to the transportation industry. Drilling down a bit further on that, a 15% drop in equipment sales due to lower prices for units sold caused the weakness.

Another blemish on its financials is that the company carries a rather high level of debt, especially for a software company. Software companies don’t typically have much debt because it’s not a capital intensive industry, so, that was a bit surprising to see. AMQ may use some of the IPO proceeds to pay down that debt, but, it would be far more preferable if it could use all of its IPO proceeds for growth purposes.

Taking a look at valuation, AMQ’s P/S would be a relatively cheap 2.6x annualized FY15 revenue, based on its IPO pricing at the mid-point. In a “normal” market, that valuation may be viewed as quite conservative for a software company. But, in today’s market, the question is whether that valuation will be cheap enough to spark some interest, especially given the drop in revenue growth.

Conclusion

Overall, AMQ is a solid company that appears to be well run. Its profitability and cash flow generation is a testament to that. However, is AMQ an exciting enough story to entice hesitant investors off the sidelines?

This question brings us to perhaps the biggest concern with AMQ — its revenue was almost flat from a year ago. Many IPO investors are seeking out premier, top-flight growth stories, looking to get in on the ground floor of an up-and-coming company. If they can find that, along with an improving bottom line and a reasonable valuation, then interest in the IPO (in a healthy market) is going to be robust.

With AMQ, the profitability and the reasonable valuation are there. But, the most important element (strong, rising revenue growth), especially for a tech company, is not. It’s exposure to the very weak transportation industry certainly does not help matters, either.

For these reasons, it would be surprising if AMQ is able to drum up enough demand to secure a solid pricing, assuming conditions in the market don’t change significantly next week.