If you are looking for a technical silver lining amidst the recent carnage, the S&P 500 has bounced off its 200-week moving average. That is an important level and I’m glad to report it was respected this week. Whew!

Want more good news? Although the S&P 500 is down about 12.6% from its May 2015 all-time high, the rest of the world is faring much worse. Most European indices topped out in 2014 and are now more than 20% below their highs, which is ‘official’ bear market territory. And Spain is literally crashing, already down 49%!

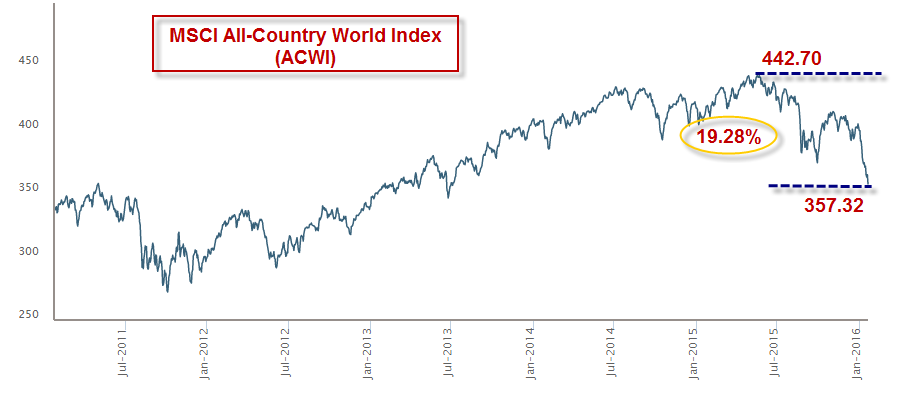

But the real kicker is that the MSCI All-Country World Index, a measure of 46 developed and emerging markets, is now down almost 20% from its peak (see accompanying chart.) Therefore, the not-so-good news is that the U.S. is now the best house in a bad neighborhood that spans the entire globe.

Q: Why is it important to look at the really BIG picture?

A: Globalization.

Globalization is not a new theme; it’s been around for thousands of years, but modern technology has accelerated the process. Since 1950, for example, the volume of world trade has increased 20-fold. Trade barriers have fallen, corporations have outsourced and relocated, jobs have been imported and exported, etc. Today, more than 1.5 billion people now fly on airlines annually.

Meanwhile, $1 trillion in direct foreign investment (DFI) changes hands every year and this is not just about emerging markets. The U.S. is the largest recipient of DFI, accounting for one-quarter of the total.

Increasing globalization has also changed the way institutional investors everywhere manage their portfolios. A growing number of top level managers have abandoned the traditional model that splits domestic and international equity, preferring to consider global equity as a single strategic asset class. This is a new development and it implies a more synchronized investing world.

The MSCI All-Country World Index was created to afford managers a single integrated view of equity returns in 23 developed and 23 emerging markets. It captures the full spectrum of global equity performance without a ‘home’ bias. For practical investment purposes, the world is now integrated.

The bad news is that it is acting that way… and about to sink into bear territory. Volume on the ETF that tracks the index (ACWI) is surging. This ETF, down 9% this month, dropped below its 200-week moving average during the first week of the year. The technicals look terrible, so I expect that globally, equity rallies will be sold. The world is busy pricing in a global recession.

So if you are looking for an explanation about why our markets fell out of bed so fast, and if later this spring we find that the U.S. market can’t get back on its feet, we know where to look for the answer. Everywhere.