We’d been watching the stock market closely towards the end of the year because we saw significant commercial trader selling in October and November. This placed the small speculators as the lone group still buying the market during fall’s consolidation. We mentioned this initially on December 22nd in, Small Speculators Got Greedy in the S&P 500.” Then, once again, right here at TraderPlanet in, This Week is All About the S&P 500,” where we closed with, “…we feel that equity rallies are to be sold until the market proves itself in the form of new highs or, a decline deep enough to put commercial traders back on the buy side.” Well, the market has declined more than 14% from close to low since then and this decline has been steep enough to bring commercial traders back to the buy side.

Commercial traders were net short nearly 20,000 contracts when we wrote the previous piece. Since the market’s decline, they’ve adjusted their total net position to net long approximately 35,000 contracts. Clearly, they’ve come in to buy the decline as anticipated. This makes all the sense in the world considering that a buy and hold methodology of new funds placed in the equity markets at this point are guaranteed to beat the index by the difference between December 31st’s close and Friday’s close. This provides a range of buying opportunities at up to an 11.5% discount from 2015’s close. Any money manager beating the index by 10% is sure to accrue quite a bonus! Therefore, it is their buying on this decline that interests us.

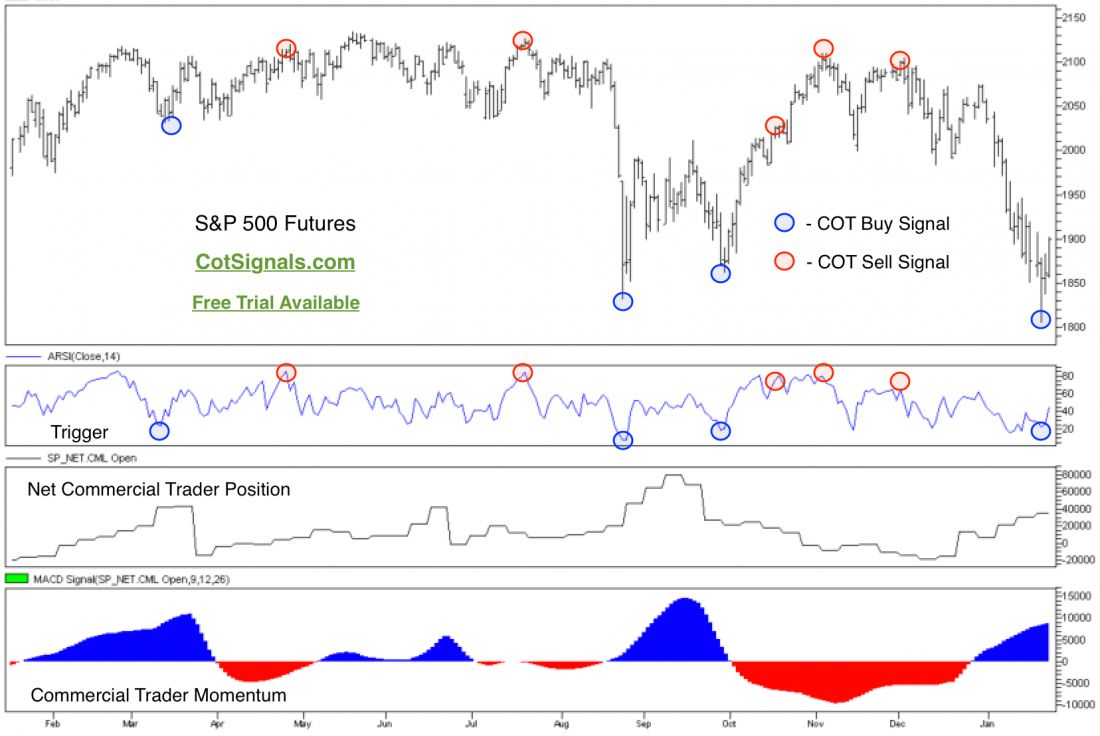

Looking at the chart, you can see that we only buy when commercial momentum is positive and the market is oversold. Conversely, we only sell when commercial trader is negative and the market is overbought. Individual traders simply don’t (and shouldn’t) attempt to have the same staying power as institutional traders. Therefore, we attempt to time our entries to the potentially most explosive opportunities. These usually occur when the market is at its most imbalanced. In this case, the market is sold off by large and small speculators as commercial traders shift to the buy side. Obviously, the inverse is what occurred near the market’s highs as commercial traders and their momentum turned negative while small speculator buying held us within our trading range…for a while.

The recent and concerted buying by the commercial traders as this market corrected roughly 15% is exactly the type of action we try to get behind. We’ll be buying the stock indices, including the S&P 500. However, because the markets are always an uncertain proposition, we will be placing protective sell stops at Thursday’s low of 1804.25. We always trade with resting protective stop orders in the market. Meanwhile, we’ll see what happens within the makeup of the Commitment of Traders report between the market’s participants as we attempt a run back towards 2,000 in the S&P 500 futures.

For mechanical and discretionary trading signals based on this methodology please see, CotSignals.com.