With the U.S. Dollar possibly ready to decline into spring, as we described in an earlier post at TraderPlanet, the next few months should offer a favorable environment for long trades in paired currencies. Just as the larger trend with the Dollar is upward, Yen/Dollar futures have been trading downward in a pattern we have been writing about since 2011. However, between now and approximately April or May, price should move counter to the trend.

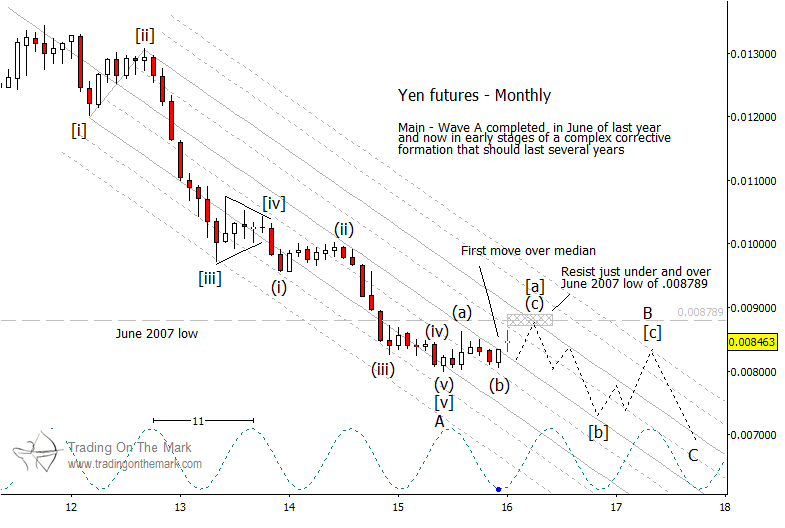

The strong, non-overlapping character of the Yen’s downward trend clearly has been impulsive, and Elliott wave rules led us to expect a five-wave [i]-[ii]-[iii]-iv]-[v] structure for the decline. That structure may have been completed in 2015, and the higher low in December may have marked a step upward in the next corrective pattern to come after the impulsive one.

Even though we believe the Yen is correcting “upward,” that does not mean it will be easy to hold long trades for more than a few weeks or months. It is quite possible for a correction to move generally sideways, or even generally downward, while still qualifying as a countertrend pattern. The way that the Yen has adhered closely to the boundaries and harmonics of the channel we have drawn on the monthly chart below suggests that there will be continued downward pressure and resistance even during a correction. Successful trades in both directions during approximately the next two years will require careful entries and relatively fast time frames.

Looking at near-term opportunities, the next stage of the correction should involve an upward wave (c) of larger upward wave [a] within the correction. An attractive area to cap the upward move is the confluence of the channel’s upper boundary and the important price low that was set in 2007 (indicated with the dashed line on the chart). Targets for a rally this winter and spring should be in the vicinity of 0.008789, or 113.8 if you are watching the inverse.

Get charts and alerts for the next trade setups in currencies and other futures markets. Subscribe to Trading On The Mark today!